Instructions For Form St-500 5182 - Moving To South Carolina A Tax Guide For New Residents Page 6

ADVERTISEMENT

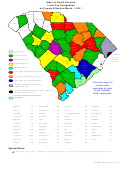

State of South Carolina

Local Tax Designation

by County Effective March 1, 2011

Cherokee

Greenville

7/96 SD

York

5/09 L

5/98

Spartanburg

Pickens

5/95

Lancaster

Chester

Oconee

Chesterfield

5/92 L

5/94 L

Union

5/97 L

5/09 CP

Marlboro

5/09 CP

9/00 SD

Anderson

5/92

Laurens

Dillon

5/99

Fairfield

Darlington

5/96 L

Kershaw

5/06

5/97 L

Newberry

10/08 SD

5/97

Lee

2/04 SD

5/99

Abbeville

5/96 L

Marion

Greenwood

5/92

10/06 SD

Florence

7/91

Richland

5/07

Saluda

Horry

5/94 L

Sumter

5/05

5/92

McCormick

Lexington

5/07 CP

5/07 CP

5/96 L

7/91

3/05

3/09 ECI

5/09 CP

Edgefield

Non Local Tax

5/92

Clarendon

Aiken

Calhoun

5/97 L

Myrtle Beach

5/01

Williamsburg

5/05

Local Option Tax

6/04 SD

5/97

5/07 CP

3/09 ECI

School District Tax

Georgetown

Orangeburg

8/09 TD

5/99

Capital Projects Tax

Barnwell

Berkeley

5/99

Bamberg

5/97 L

Transportation Tax

Dorchester

5/92

5/09 TT

5/05

Allendale

Local Option and Capital Projects Tax

5/92 L

Colleton

5/09 CP

Local Option and School District Tax

Hampton

7/91

Charleston

7/91

Local Option and Transportation Tax

7/91 L, 5/05 TT

This chart does not

3/11 ECI

Jasper

Education Capital Improvement and

contain rates

Capital Projects Tax

Beaufort

7/91 L

applicable to sales

5/07

12/02 SD

Education Capital Improvement, Capital Projects and

to the Catawba

Tourism Development Tax

Indian reservation

Local Option, Transportation and Education Capital

Improvement Tax

Chesterfield

8%

Hampton

7%

Newberry

7%

Abbeville

7%

Aiken

7%

Clarendon

8%

Horry

8%

Oconee

6%

Colleton

7%

Horry

9%

Orangeburg

7%

Allendale

8%

(Myrtle Beach)

Anderson

6%

Darlington

8%

Jasper

8%

Pickens

7%

Bamberg

7%

Dillon

8%

Kershaw

7%

Richland

7%

Barnwell

7%

Dorchester

7%

Lancaster

8%

Saluda

7%

Beaufort

7%

Edgefield

7%

Laurens

7%

Spartanburg

6%

Berkeley

8%

Fairfield

7%

Lee

8%

Sumter

8%

Calhoun

7%

Florence

8%

Lexington

7%

Union

6%

Charleston

8.5%

Georgetown

6%

McCormick

7%

Willamsburg

7%

Cherokee

8%

Greenville

6%

Marion

7%

York

7%

Chester

8%

Greenwood

7%

Marlboro

7%

Special Notice

Effective March 1, 2011, Charleston County imposed a 1 percent (.01) Education Capital Improvement Tax.

ST-500 5182 (Revised 2/11/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6