Form 10-A - Application For Municipal Income Tax Refund

ADVERTISEMENT

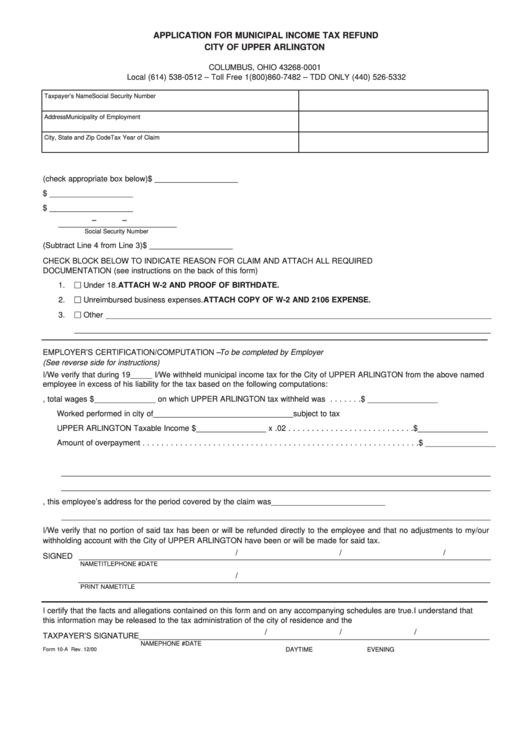

APPLICATION FOR MUNICIPAL INCOME TAX REFUND

CITY OF UPPER ARLINGTON

P.O. BOX L-017

COLUMBUS, OHIO 43268-0001

Local (614) 538-0512 – Toll Free 1 (800) 860-7482 – TDD ONLY (440) 526-5332

Taxpayer’s Name

Social Security Number

Address

Municipality of Employment

City, State and Zip Code

Tax Year of Claim

1.

Name of Employer

___________________________________________

2.

Amount of income exempt from tax (check appropriate box below)

$ ___________________

3.

Amount of gross refund claimed

$ ___________________

4.

Amount you want credited to your individual account

$ ___________________

–

–

___________________________

Social Security Number

5.

Net Amount to be refunded (Subtract Line 4 from Line 3)

$ ___________________

CHECK BLOCK BELOW TO INDICATE REASON FOR CLAIM AND ATTACH ALL REQUIRED

DOCUMENTATION (see instructions on the back of this form)

1.

Under 18. ATTACH W-2 AND PROOF OF BIRTHDATE.

2.

Unreimbursed business expenses. ATTACH COPY OF W-2 AND 2106 EXPENSE.

3.

Other ________________________________________________________________________________________

_______________________________________________________________________________________________

EMPLOYER’S CERTIFICATION/COMPUTATION – To be completed by Employer

(See reverse side for instructions)

I/We verify that during 19_____ I/We withheld municipal income tax for the City of UPPER ARLINGTON from the above named

employee in excess of his liability for the tax based on the following computations:

A. From W-2, total wages $______________ on which UPPER ARLINGTON tax withheld was . . . . . . .$ ________________

Worked performed in city of ________________________________subject to tax

UPPER ARLINGTON Taxable Income $________________ x .02 . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ________________

Amount of overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ________________

B. Basis for refund ______________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

C. According to our records, this employee’s address for the period covered by the claim was __________________________

__________________________________________________________________________________________________

I/We verify that no portion of said tax has been or will be refunded directly to the employee and that no adjustments to my/our

withholding account with the City of UPPER ARLINGTON have been or will be made for said tax.

/

/

/

SIGNED ______________________________________________________________________________________________

NAME

TITLE

PHONE #

DATE

/

______________________________________________________________________________________________

PRINT NAME

TITLE

I certify that the facts and allegations contained on this form and on any accompanying schedules are true. I understand that

this information may be released to the tax administration of the city of residence and the I.R.S.

/

/

/

TAXPAYER’S SIGNATURE ________________________________________________________________________________

NAME

PHONE #

DATE

Form 10-A Rev. 12/00

DAYTIME

EVENING

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1