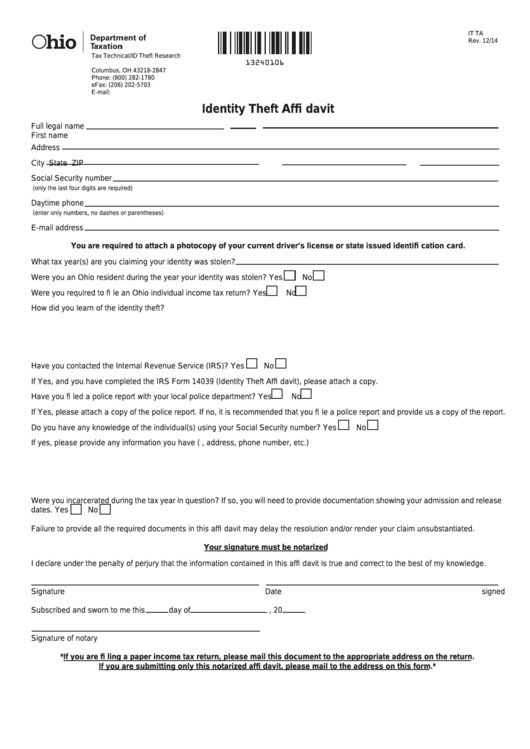

Reset Form

IT TA

Rev. 12/14

Tax Technical/ID Theft Research

P.O. Box 182847

Columbus, OH 43218-2847

Phone: (800) 282-1780

eFax: (206) 202-5703

E-mail: OhioIDTheft@tax.state.oh.us

Identity Theft Affi davit

Full legal name

First name

M.I.

Last name

Address

City

State

ZIP

Social Security number

(only the last four digits are required)

Daytime phone

(enter only numbers, no dashes or parentheses)

E-mail address

You are required to attach a photocopy of your current driver’s license or state issued identifi cation card.

What tax year(s) are you claiming your identity was stolen?

Were you an Ohio resident during the year your identity was stolen? Yes

No

Were you required to fi le an Ohio individual income tax return? Yes

No

How did you learn of the identity theft?

Have you contacted the Internal Revenue Service (IRS)? Yes

No

If Yes, and you have completed the IRS Form 14039 (Identity Theft Affi davit), please attach a copy.

Have you fi led a police report with your local police department? Yes

No

If Yes, please attach a copy of the police report. If no, it is recommended that you fi le a police report and provide us a copy of the report.

Do you have any knowledge of the individual(s) using your Social Security number? Yes

No

If yes, please provide any information you have (i.e. name, address, phone number, etc.)

Were you incarcerated during the tax year in question? If so, you will need to provide documentation showing your admission and release

dates. Yes

No

Failure to provide all the required documents in this affi davit may delay the resolution and/or render your claim unsubstantiated.

Your signature must be notarized

I declare under the penalty of perjury that the information contained in this affi davit is true and correct to the best of my knowledge.

Signature

Date signed

Subscribed and sworn to me this

day of

, 20

Signature of notary

*If you are fi ling a paper income tax return, please mail this document to the appropriate address on the return.

If you are submitting only this notarized affi davit, please mail to the address on this form.*

1

1