PRINT

CLEAR

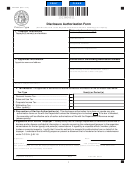

RD1062

Disclosure Authorization Form

Purpose of Form

A taxpayer may use Form RD1062 to authorize the Georgi

a Department of Revenue to disclose and/or discuss

confidential tax information for such taxpayer with an appointee for a specific tax type(s) and period(s). Form RD1062

cannot be used as a Power of Attorney and thus does not grant the appointee any powers of representation.

Filing Instructions

Taxpayers should submit Form RD1062 to the appropriate taxing division. Taxpayers should only use this form when

submitting a specific request for information.

Specific Instructions

Section 1 - Taxpayer Information

Individuals - Enter your name, address, and any applicable identification numbers.

Section 2 - Appointee

Enter the appointee's name, address, and any applicable identification numbers.

Section 3 - Authorization

Enter the tax type(s) and specific period(s) or year(s) for which the authorization is granted. A general reference to "all

years" or "all periods" is not acceptable.

Section 4 - Retention/Revocation of Prior Disclosure Authorization Forms

All existing disclosure authorization forms previously filed by the taxpayer will not be revoked unless the taxpayer checks

the box on this line. If the taxpayer checks off this box but does not want to revoke all existing disclosure authorization

forms, the taxpayer should either specify the forms that the department should retain or attach a copy of such existing

form(s).

A taxpayer may revoke a disclosure authorization form without authorizing a new appointee by filing with the department

either:

(1) A statement of revocation signed by the taxpayer indicating that the authority of the previous disclosure authorization

form is revoked along with the name and address of each appointee whose authority is revoked; or

(2) A copy of the disclosure authorization form to be revoked clearly marked "REVOKED."

It is important to note that the filing of a Form RD1062 disclosure authorization form will not revoke any Power of Attorney

that is in effect.

Section 5 - Signature of Taxpayer

Taxpayer

Who must sign

Individuals

The individual/sole proprietor must sign.

Corporations

A corporate officer or a person designated by a corporate officer must sign.

Partnerships

A partner having authority to act in the name of the partnership must sign.

Trusts

A Trustee must sign.

Estates

An Executor/Executrix or the personal representative of the estate must sign.

Limited Liability Companies

A member having authority to act in the name of the company must sign.

2

1

1 2

2