Reset Form

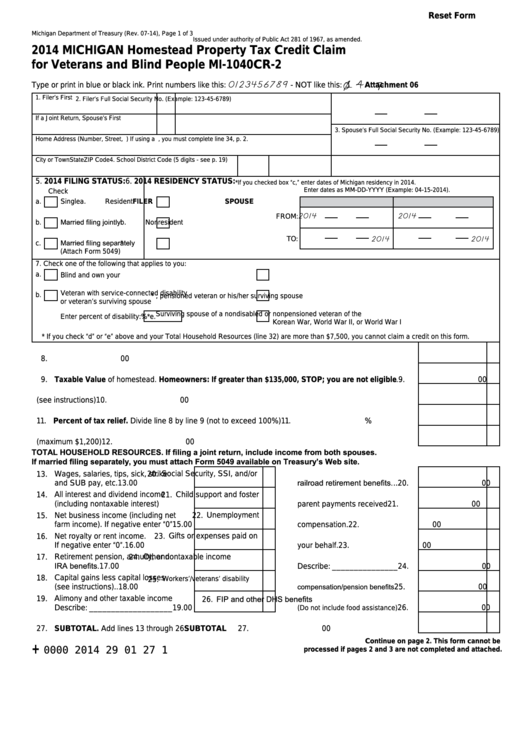

Michigan Department of Treasury (Rev. 07-14), Page 1 of 3

Issued under authority of Public Act 281 of 1967, as amended.

2014 MICHIGAN Homestead Property Tax Credit Claim

for Veterans and Blind People MI-1040CR-2

1 4

0123456789

Type or print in blue or black ink. Print numbers like this:

- NOT like this:

Attachment 06

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Full Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, P.O. Box) If using a P.O. Box, you must complete line 34, p. 2.

City or Town

State

ZIP Code

4. School District Code (5 digits - see p. 19)

5. 2014 FILING STATUS:

6. 2014 RESIDENCY STATUS:

*If you checked box “c,” enter dates of Michigan residency in 2014.

Enter dates as MM-DD-YYYY (Example: 04-15-2014).

Check one.

Check all that apply.

a.

Single

a.

Resident

FILER

SPOUSE

2014

2014

FROM:

Married filing jointly

b.

b.

Nonresident

2014

2014

TO:

Married filing separately

c.

c.

Part-Year Resident *

(Attach Form 5049)

7. Check one of the following that applies to you:

a.

Blind and own your homestead

c.

Surviving spouse of veteran deceased in service

Veteran with service-connected disability

b.

*d.

Active military, pensioned veteran or his/her surviving spouse

or veteran’s surviving spouse

Surviving spouse of a nondisabled or nonpensioned veteran of the

Enter percent of disability:

%

*e.

Korean War, World War II, or World War I

* If you check “d” or “e” above and your Total Household Resources (line 32) are more than $7,500, you cannot claim a credit on this form.

8. Taxable value allowance from Table 2 ...................................................................................................

8.

00

9. Taxable Value of homestead. Homeowners: If greater than $135,000, STOP; you are not eligible ..

9.

00

10. Property Taxes levied on your home for 2014 (see instructions) ........................................................... 10.

00

11. Percent of tax relief. Divide line 8 by line 9 (not to exceed 100%) ...................................................... 11.

%

12. Multiply line 10 by line 11. Enter the result (maximum $1,200) ............................................................. 12.

00

TOTAL HOUSEHOLD RESOURCES. If filing a joint return, include income from both spouses.

If married filing separately, you must attach Form 5049 available on Treasury’s Web site.

13. Wages, salaries, tips, sick, strike

20. Social Security, SSI, and/or

railroad retirement benefits. ..

and SUB pay, etc. .........................

13.

00

20.

00

14. All interest and dividend income

21. Child support and foster

(including nontaxable interest).......

14.

00

parent payments received ....

21.

00

15. Net business income (including net

22. Unemployment

farm income). If negative enter “0”

15.

00

compensation. ...................... 22.

00

16. Net royalty or rent income.

23. Gifts or expenses paid on

If negative enter “0”. ......................

16.

00

your behalf. ........................... 23.

00

17. Retirement pension, annuity, and

24. Other nontaxable income

IRA benefits. ..................................

17.

00

Describe: _______________ 24.

00

18. Capital gains less capital losses

Workers’/veterans’ disability

25.

compensation/pension benefits

(see instructions).. .........................

18.

00

25.

00

26. FIP and other DHS benefits

19. Alimony and other taxable income

Describe: ___________________

19.

00

26.

00

(Do not include food assistance)

27. SUBTOTAL. Add lines 13 through 26 ............................................................................. SUBTOTAL

27.

00

Continue on page 2. This form cannot be

+

0000 2014 29 01 27 1

processed if pages 2 and 3 are not completed and attached.

1

1 2

2 3

3