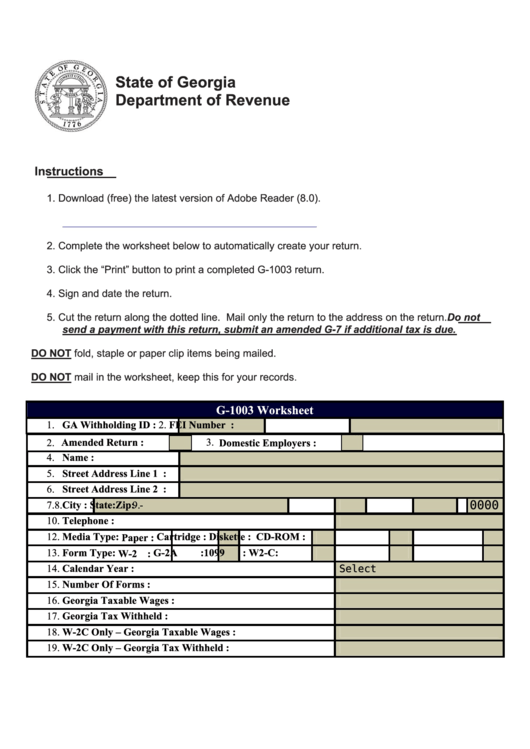

State of Georgia

Department of Revenue

Instructions

1. Download (free) the latest version of Adobe Reader (8.0).

2. Complete the worksheet below to automatically create your return.

3. Click the “Print” button to print a completed G-1003 return.

4. Sign and date the return.

5. Cut the return along the dotted line. Mail only the return to the address on the return. Do not

send a payment with this return, submit an amended G-7 if additional tax is due.

DO NOT fold, staple or paper clip items being mailed.

DO NOT mail in the worksheet, keep this for your records.

G-1003 Worksheet

1. GA Withholding ID :

2. FEI Number :

Amended Return :

3.

2.

Domestic Employers :

4. Name : .............................

5.

Street Address Line 1 :

6.

Street Address Line 2 :

7.

City :

8.

State:

9.

Zip:

-

0000

10. Telephone : ..............................................................................

12. Media Type:

Cartridge :

Diskette :

CD-ROM :

Paper :

13.

Form Type:

G-2A

:

1099

:

W2-C:

W-2 :

14. Calendar Year :.......................................................................

Select

15.

Number Of Forms : ...............................................................

16.

Georgia Taxable Wages : ......................................................

17.

Georgia Tax Withheld : .........................................................

18. W-2C Only – Georgia Taxable Wages : ...............................

19.

W-2C Only – Georgia Tax Withheld : ..................................

Print

Clear

1

1 2

2