Instructions for Preparing the G-1003

Employers reporting 250 or more income statements must submit them on magnetic media. Employers

with less than 250 statements may report on magnetic media or paper copy. To obtain a copy of our

specifications, visit our website call or 404-417-3210.

Income statements are due on or before the end of February of the following calendar year. If this date

is a weekend or holiday, the due date is the next business day. If a business closes during the taxable

year, income statements are due within 30 days after payment of final wages.

Submit non-wage statements (1099s) only if Georgia tax is withheld. Statements that do not indicate

Georgia tax withheld may be filed under the Combined Federal/State Filing Program.

Do not send payments with this form. Submit an amended Form G-7 if additional tax is due.

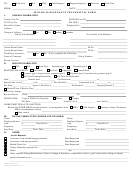

The “Number of Forms”, “Media Type”, “Form Type” “Georgia Taxable Wages” and “Georgia Tax

Withheld” blocks must be completed.

Submit Form G-1003 and magnetic media or paper copy income statements to:

Georgia Department of Revenue

Processing Center

P.O. Box 105685

Atlanta, GA 30348-5685

DO NOT mail this entire page. Cut along dotted line and mail only coupon and payment

DO NOT STAPLE OR PAPER CLIP. PLEASE REMOVE ALL CHECK STUBS

Cut on dotted line

G-1003

(Rev. 11/07)

MAIL TO:

Income Statement Transmittal

2008

Georgia Department of Revenue

Amended Return

Processing Center

Domestic employer

P.O. Box 105685

with no GA Tax Withheld

Atlanta, GA 30348-5685

DO NOT SUBMIT PAYMENT WITH THIS FORM

GA Withholding ID

FEI Number

Tax Year

Number of Forms

Vendor Code

Dept Use Only

040

0000

EMPLOYER NAME AND ADDRESS

M

e

d

a i

T

y

p

e

F

r o

m

T

y

p

e

Paper

Cartridge

Diskette

CD-ROM

W-2

G-2A

1099

W2-C

G

e

o

g r

a i

T

a

x

a

b

e l

W

a

g

e

s

G

e

o

g r

a i

T

a

x

W

i

h t

h

e

d l

W

2 -

C

O

n

y l

W

2 -

C

O

n

y l

G

e

o

g r

a i

T

a

x

a

b

e l

W

a

g

e

s

G

e

o

g r

a i

T

a

x

W

i

h t

h

e

d l

I delcare under the penalty of perjury that this return has been examined by me and to the best of my knowledge is a true and complete

return.

Date Received

S

g i

n

a

u t

e r

T

itle

T

e

e l

p

h

o

n

e

D

a

e t

1

1 2

2