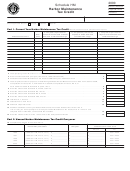

Schedule 5922 - Financial Services Development Credit Schedule - State Of Vermont - 2003 Page 2

ADVERTISEMENT

VT 2003 Financial Services Development Credit

Credit Allocation for Partnerships, Subchapter S Corporations and

(1)

Limited Liability Companies or Trusts

Entity:

FEIN:

FYE:

VBA:

4. Distribution among partners, members, shareholders, or beneficiaries. (Distribution must be in

the same proportion as the distribution of income.)

(1)

Name

SSN

Distribution % Ownership %

Available %

(Percentage from

Distribution % X

line 1(c))

Ownership %

Total:

(equal 100%)

(equal line 1c)

(1) - Attach a copy of the completed Financial Services Development Credit Schedule (Schedule 5922(PT))

to the entity's Vermont Business Income Tax Return (VT Form BI-471) for the year the credit is claimed.

Provide to each partner, member, shareholder, or beneficiary a copy of the Financial Sevices Development

Credit for Current Year for Partners, Members, Shareholders, or Beneficiaries (the third page of this

schedule), providing the required entity information for their use in computing their applicable individual

Financial Services Development Credit amount. If the Entity is a Sole Proprietorship, a copy of the

completed Financial Services Development Credit Schedule (Schedule 5922(PT)) must be attached to

the filed VT Form IN-111 for the year the credit is claimed along with a complete copy of the filed

Federal form 1040 and ALL schedules.

Schedule 5922(PT)(1203)

Page 2 of 3 Pages

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3