Form 1040xn - Amended Nebraska Individual Income Tax Return - 2007

ADVERTISEMENT

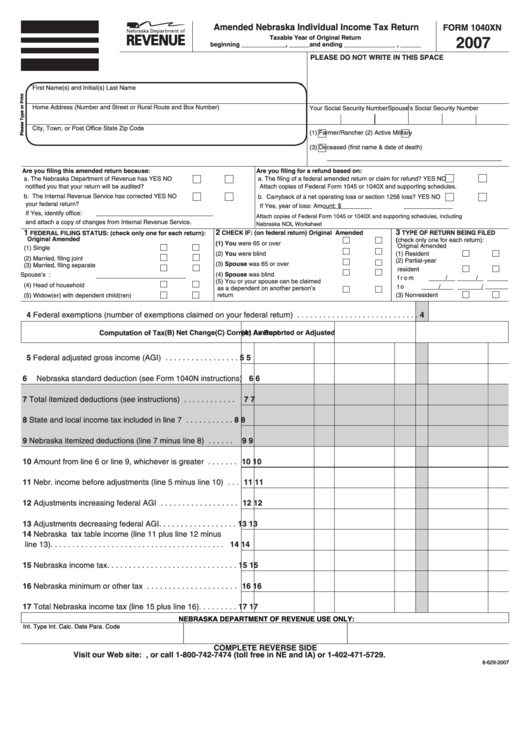

Amended Nebraska Individual Income Tax Return

FORM 1040XN

2007

Taxable Year of Original Return

beginning _____________, ______and ending _______________ , ______

PLEASE DO NOT WRITE IN THIS SPACE

First Name(s) and Initial(s)

Last Name

Home Address (Number and Street or Rural Route and Box Number)

Your Social Security Number

Spouse’s Social Security Number

City, Town, or Post Office

State

Zip Code

(1)

Farmer/Rancher

(2)

Active Military

(3)

Deceased (first name & date of death)

Are you filing this amended return because:

Are you filing for a refund based on:

a. The Nebraska Department of Revenue has

YES

NO

a. The filing of a federal amended return or claim for refund?

YES

NO

notified you that your return will be audited?

Attach copies of Federal Form 1045 or 1040X and supporting schedules.

b. The Internal Revenue Service has corrected

YES

NO

b. Carryback of a net operating loss or section 1256 loss?

YES

NO

your federal return?

If Yes, year of loss:

Amount: $

If Yes, identify office:

Attach copies of Federal Form 1045 or 1040X and supporting schedules, including

and attach a copy of changes from Internal Revenue Service.

Nebraska NOL Worksheet

2

3

1

CHECK IF: (on federal return)

Original Amended

TYPE OF RETURN BEING FILED

FEDERAL FILING STATUS: (check only one for each return):

Original

Amended

(check only one for each return):

(1) You were 65 or over

Original

Amended

(1) Single

(2) You were blind

(1) Resident

(2) Married, filing joint

(2) Partial-year

(3) Spouse was 65 or over

(3) Married, filing separate

resident

(4) Spouse was blind

Spouse’s S.S. No.:

from

/

/

(5) You or your spouse can be claimed

(4) Head of household

to

/

/

as a dependent on another person’s

(5) Widow(er) with dependent child(ren)

return

(3) Nonresident

4 Federal exemptions (number of exemptions claimed on your federal return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

(A) As Reported or Adjusted

(B) Net Change

(C) Correct Amount

Computation of Tax

5 Federal adjusted gross income (AGI) . . . . . . . . . . . . . . . . .

5

5

6 Nebraska standard deduction (see Form 1040N instructions) 6

6

7 Total itemized deductions (see instructions) . . . . . . . . . . . .

7

7

8 State and local income tax included in line 7 . . . . . . . . . . .

8

8

9 Nebraska itemized deductions (line 7 minus line 8) . . . . . .

9

9

10 Amount from line 6 or line 9, whichever is greater . . . . . . . 10

10

11 Nebr. income before adjustments (line 5 minus line 10) . . . 11

11

12 Adjustments increasing federal AGI . . . . . . . . . . . . . . . . . . 12

12

13 Adjustments decreasing federal AGI . . . . . . . . . . . . . . . . . . 13

13

14 Nebraska tax table income (line 11 plus line 12 minus

14

14

line 13). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Nebraska income tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

15

16 Nebraska minimum or other tax . . . . . . . . . . . . . . . . . . . . . 16

16

17 Total Nebraska income tax (line 15 plus line 16). . . . . . . . . 17

17

NEBRASKA DEPARTMENT OF REVENUE USE ONLY:

Int. Type

Int. Calc. Date

Para. Code

COMPLETE REVERSE SIDE

Visit our Web site: , or call 1-800-742-7474 (toll free in NE and IA) or 1-402-471-5729.

8-629-2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3