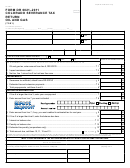

Form Fr-329 - Consumer Use Tax On Purchases And Rentals - 2011 Page 2

ADVERTISEMENT

Instructions for Form FR-329

Criminal penalties

You will be penalized under the criminal provisions of the DC

Who should file Form FR-329?

Code, Title 47 if you are required to file a return or report, or

File Form FR-329 if during tax year 2011 you paid a total of more than

perform any act and you –

$400 for merchandise, services, or rentals on which you did not pay

• F ail to file the return or report timely. If convicted, you will

sales tax. Typically, you do not pay sales tax on:

be fined not more than $1,000 or imprisoned for not more

than 180 days, or both, for each failure or neglect;

• Merchandise you ordered through catalogs;

• W illfully fail to file the return or report timely. If convicted,

• Merchandise shipped to DC that you bought or rented outside

you will be fined not more than $5,000 or imprisoned for

DC; and

not more than 180 days, or both;

• M erchandise taxed in DC but not in the state where purchased.

• W illfully attempt to evade or defeat a tax; willfully fail to

collect, account for, or pay a tax; or willfully making fraud

Do not file Form FR-329 for a business. Businesses should file a Form

and false statements or failing to provide information. See

FR-800A (annual return), Form FR-800Q (quarterly return), or a Form

DC Code §§47-4101 through 4107.

FR-800M (monthly return) to report sales tax (in the “use tax” section)

These penalties are in addition to penalties under DC Code §22-

on such purchases and rentals.

2405 for false statements (and any other applicable penalties).

Taxpayer Identification Number(s) (TIN)

Corporate officers may be held personally liable for the payment

You must have a TIN, whether it be a SSN or FEIN.

of taxes owed to DC, if not paid.

• If you apply for a SSN, it must be a valid number issued by the

Sales tax you owe

Social Security Administration (SSA) or the United States Govern-

Include shipping and handling charges in the sales price when

ment. To apply for a SSN, get Form SS-5, Application for a Social

they are listed as a line item on the bill.

Security Card, from your local SSA office or get this form online at

You may also get this form by calling 1-800-772-

Line 1 Merchandise, services and rentals

1213.

Enter the total sales price of all your purchases of merchandise,

You must wait until you receive your SSN before you file a DC return.

services and rentals on which you did not pay any DC or state

Your return may be rejected if your SSN is missing or incorrect.

sales tax. Multiply the amount by .06 and enter the result in

the tax column.

Dishonored payment

You will be charged $65 for any payment not honored by your financial

Taxable merchandise includes, but is not limited to, furniture,

institution and returned to OTR.

clothing, shoes, jewelry, perfume, cosmetics, computer hardware

and software, appliances, electronic equipment, cameras,

International ACH Transaction (IAT)

antiques, art, office supplies, sporting goods and rare coins.

For electronic payers, in order to comply with the new banking rules,

you will be asked the question “Will the funds for this payment come

Taxable services include data processing, real property

from an account outside the United States?”. If the answer is yes,

maintenance, information services, dry cleaning, landscaping,

you will be required to pay by check or credit card. Please notify this

photographic services and film processing.

agency if your response changes in the future.

Taxable rentals include rental of furniture, televisions, stereos,

Penalty and interest charges

computer hardware and software and lawn equipment.

OTR will charge -

• A penalty of 5% per month if you fail to file a return or pay any

Line 2 Alcoholic beverages

tax due on time. It is computed on the unpaid tax for each month,

Enter the total sales price of all your purchases of alcoholic

or fraction of a month, that the return is not filed or the tax is not

beverages on which you did not pay any DC or state sales

paid. It may not exceed an additional amount equal to 25% of the

tax. Multiply the amount by .09 and enter the result in the tax

tax due;

column.

• A 20% penalty on the portion of an underpayment of taxes if attrib-

Line 3 Purchases of catered food or drink or rentals of non-

utable to negligence. Negligence is a failure to make a reasonable

commercial vehicles.

attempt to comply with the law or to exercise ordinary and reason-

able care in preparing tax returns without the intent to defraud.

Enter the total sales price of all your purchases and rentals on

One indication of negligence is a failure to keep adequate books

which you did not pay any DC or state sales tax. Multiply the

and records;

.

amount by

10 and enter the result in the tax column.

• I nterest of 10% per year, compounded daily, on a late payment.

Line 4 Purchases of certain other tobacco products

• A one-time fee to cover internal collection efforts on any unpaid

Enter the total sales price of all your purchases of any product

balance. The collection fee assessed is 20% of the tax balance due

made primarily from tobacco that is intended for consumption by

after 90 days. Payments received by OTR on accounts subject to

smoking, by chewing or as snuff on which you did not pay any

the fee are first applied to the fee then to penalty, interest and tax

DC or state sales tax. This tax rate does not apply to cigarettes,

owed;

premium cigars or pipe tobacco. A premium cigar is any individual

• A civil fraud penalty of 75% of the underpayment which is attribut-

cigar with a retail cost of $2 or more or a packaged unit of cigars

able to fraud (see DC Code §§47-4212).

that has an average cost of $2 or more per cigar. Multiply the

Enforcement actions

amount by .12 and enter the result in the tax column.

OTR may use lien, levy, seizure, collection agencies and liability offset

Preparer Tax Identification Number (PTIN)

if a taxpayer fails to pay the District within 10 days after receiving a

A PTIN is issued by the IRS to a paid preparer who applies for

Notice of Tax Due and a demand for payment. Visit

one. A PTIN may be used for tax identification purposes, instead

. click “Information”, Collection Division”, “Enforcement

of the preparer’s SSN.

Actions”.

2011 FR-329 Consumer Use Tax on Purchases and Rentals page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2