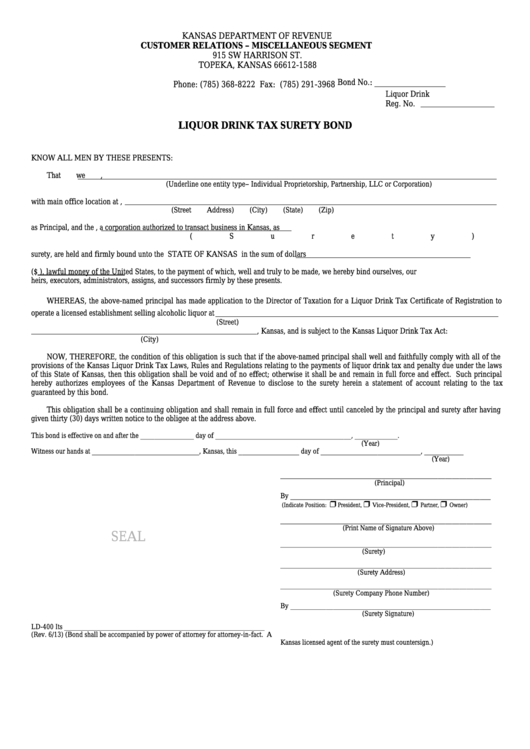

KANSAS DEPARTMENT OF REVENUE

CUSTOMER RELATIONS – MISCELLANEOUS SEGMENT

915 SW HARRISON ST.

TOPEKA, KANSAS 66612-1588

Bond No.: _________________

Phone: (785) 368-8222

Fax: (785) 291-3968

Liquor Drink

Reg. No.

LIQUOR DRINK TAX SURETY BOND

KNOW ALL MEN BY THESE PRESENTS:

That we

,

(Underline one entity type– Individual Proprietorship, Partnership, LLC or Corporation)

with main office location at

,

(Street Address)

(City)

(State)

(Zip)

as Principal, and the

, a corporation authorized to transact business in Kansas, as

(Surety)

surety, are held and firmly bound unto the STATE OF KANSAS in the sum of

dollars

($

), lawful money of the United States, to the payment of which, well and truly to be made, we hereby bind ourselves, our

heirs, executors, administrators, assigns, and successors firmly by these presents.

WHEREAS, the above-named principal has made application to the Director of Taxation for a Liquor Drink Tax Certificate of Registration to

operate a licensed establishment selling alcoholic liquor at

(Street)

, Kansas, and is subject to the Kansas Liquor Drink Tax Act:

(City)

NOW, THEREFORE, the condition of this obligation is such that if the above-named principal shall well and faithfully comply with all of the

provisions of the Kansas Liquor Drink Tax Laws, Rules and Regulations relating to the payments of liquor drink tax and penalty due under the laws

of this State of Kansas, then this obligation shall be void and of no effect; otherwise it shall be and remain in full force and effect. Such principal

hereby authorizes employees of the Kansas Department of Revenue to disclose to the surety herein a statement of account relating to the tax

guaranteed by this bond.

This obligation shall be a continuing obligation and shall remain in full force and effect until canceled by the principal and surety after having

given thirty (30) days written notice to the obligee at the address above.

This bond is effective on and after the _______________ day of ______________________________________, ____________.

(Year)

Witness our hands at ______________________________, Kansas, this _________________ day of ____________________________, ___________

(Year)

___________________________________________________________

(Principal)

By ________________________________________________________

r

r

r

r

(Indicate Position:

President,

Vice-President,

Partner,

Owner)

___________________________________________________________

(Print Name of Signature Above)

SEAL

___________________________________________________________

(Surety)

___________________________________________________________

(Surety Address)

___________________________________________________________

(Surety Company Phone Number)

By ________________________________________________________

(Surety Signature)

LD-400

Its ________________________________________________________

(Rev. 6/13)

(Bond shall be accompanied by power of attorney for attorney-in-fact. A

Kansas licensed agent of the surety must countersign.)

1

1 2

2