Form Rl-1 - Liquor Drink Tax Return

ADVERTISEMENT

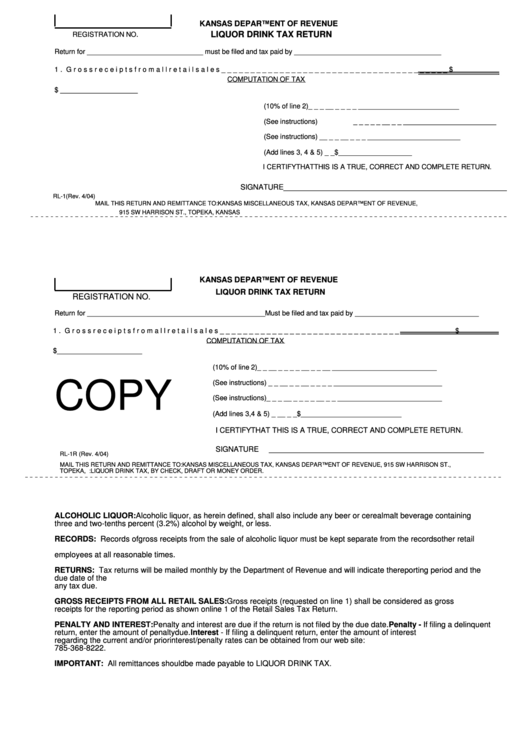

KANSAS DEPARTMENT OF REVENUE

.

LIQUOR DRINK TAX RETURN

REGISTRATION NO

Return for ______________________________ must be filed and tax paid by ______________________________________

1. Gross receipts from all retail sales _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

$

COMPUTATION OF TAX

2. Gross receipts from the sale of alcoholic liquor _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ $ ____________________

3. Tax due (10% of line 2) _ _ _ _ _ _ _ _ _ _ _________________________

4. Penalty (See instructions)

_ _ _ _ _ _ _ _ _ ________________________

5. Interest (See instructions) _ _ _ _ _ _ _ _ _ ________________________

6. TOTAL AMOUNT DUE (Add lines 3, 4 & 5) _ _$ ___________________

I CERTIFY THAT THIS IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE_____________________________________________________

RL-1 (Rev. 4/04)

MAIL THIS RETURN AND REMITTANCE TO: KANSAS MISCELLANEOUS TAX, KANSAS DEPARTMENT OF REVENUE,

915 SW HARRISON ST., TOPEKA, KANSAS 66625-5000. MAKE REMITTANCE PAYABLE TO LIQUOR DRINK TAX.

KANSAS DEPARTMENT OF REVENUE

LIQUOR DRINK TAX RETURN

REGISTRATION NO.

Return for ______________________________________________ Must be filed and tax paid by ________________________________

1. Gross receipts from all retail sales _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ $

COMPUTATION OF TAX

2. Gross receipts from the sale of alcoholic liquor _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ $

______________________

3. Tax due (10% of line 2) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

__________________________

4. Penalty (See instructions) _ _ _ _ _ _ _ _ _ _ _ _ _ _

__________________________

COPY

5. Interest (See instructions) _ _ _ _ _ _ _ _ _ _ _ _ _ _

__________________________

6. TOTAL AMOUNT DUE (Add lines 3, 4 & 5) _ _ _ _ _ $

__________________________

I CERTIFY THAT THIS IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE

___________________________________________________

RL-1R (Rev. 4/04)

MAIL THIS RETURN AND REMITTANCE TO: KANSAS MISCELLANEOUS TAX, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON ST.,

TOPEKA, KANSAS 66625-7000. MAKE REMITTANCE PAYABLE TO: LIQUOR DRINK TAX, BY CHECK, DRAFT OR MONEY ORDER.

ALCOHOLIC LIQUOR: Alcoholic liquor, as herein defined, shall also include any beer or cereal malt beverage containing

three and two-tenths percent (3.2%) alcohol by weight, or less.

RECORDS: Records of gross receipts from the sale of alcoholic liquor must be kept separate from the records other retail

sales. These records shall be available for inspection by the Secretary of Revenue or his/her duly authorized agents or

employees at all reasonable times.

RETURNS: Tax returns will be mailed monthly by the Department of Revenue and will indicate the reporting period and the

due date of the return. Failure to receive a return does not relieve a club of the responsibility to file returns timely and pay

any tax due.

GROSS RECEIPTS FROM ALL RETAIL SALES: Gross receipts (requested on line 1) shall be considered as gross

receipts for the reporting period as shown on line 1 of the Retail Sales Tax Return.

PENALTY AND INTEREST: Penalty and interest are due if the return is not filed by the due date. Penalty - If filing a delinquent

return, enter the amount of penalty due. Interest - If filing a delinquent return, enter the amount of interest due. Information

regarding the current and/or prior interest/penalty rates can be obtained from our web site: or call

785-368-8222.

IMPORTANT: All remittances should be made payable to LIQUOR DRINK TAX.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1