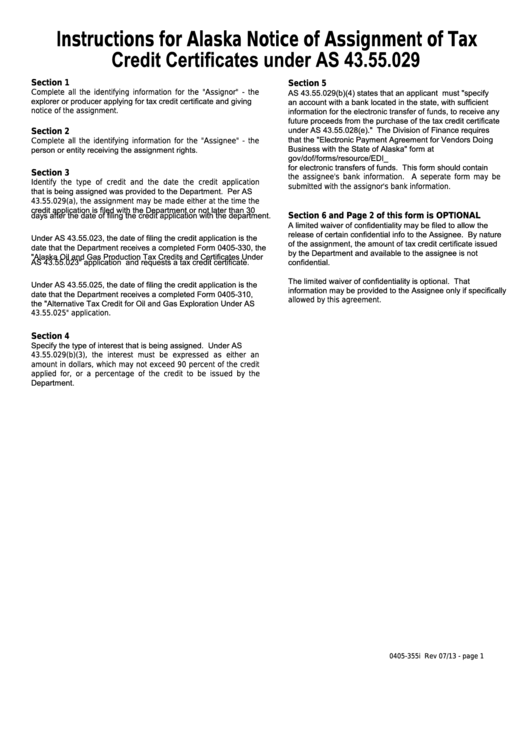

Instructions For Alaska Notice Of Assignment Of Tax Credit Certificates Under As 43.55.029

ADVERTISEMENT

Instructions for Alaska Notice of Assignment of Tax

Credit Certificates under AS 43.55.029

Section 1

Section 5

Complete all the identifying information for the "Assignor" - the

AS 43.55.029(b)(4) states that an applicant must "specify

explorer or producer applying for tax credit certificate and giving

an account with a bank located in the state, with sufficient

notice of the assignment.

information for the electronic transfer of funds, to receive any

future proceeds from the purchase of the tax credit certificate

under AS 43.55.028(e)." The Division of Finance requires

Section 2

that the "Electronic Payment Agreement for Vendors Doing

Complete all the identifying information for the "Assignee" - the

Business with the State of Alaska" form at

person or entity receiving the assignment rights.

gov/dof/forms/resource/EDI_agreement.pdf

be completed

for electronic transfers of funds. This form should contain

Section 3

the assignee's bank information. A seperate form may be

Identify the type of credit and the date the credit application

submitted with the assignor's bank information.

that is being assigned was provided to the Department. Per AS

43.55.029(a), the assignment may be made either at the time the

credit application is filed with the Department or not later than 30

Section 6 and Page 2 of this form is OPTIONAL

days after the date of filing the credit application with the department.

A limited waiver of confidentiality may be filed to allow the

release of certain confidential info to the Assignee. By nature

Under AS 43.55.023, the date of filing the credit application is the

of the assignment, the amount of tax credit certificate issued

date that the Department receives a completed Form 0405-330, the

by the Department and available to the assignee is not

"Alaska Oil and Gas Production Tax Credits and Certificates Under

confidential.

AS 43.55.023" application and requests a tax credit certificate.

The limited waiver of confidentiality is optional.

That

Under AS 43.55.025, the date of filing the credit application is the

information may be provided to the Assignee only if specifically

date that the Department receives a completed Form 0405-310,

allowed by this agreement.

the "Alternative Tax Credit for Oil and Gas Exploration Under AS

43.55.025" application.

Section 4

Specify the type of interest that is being assigned. Under AS

43.55.029(b)(3), the interest must be expressed as either an

amount in dollars, which may not exceed 90 percent of the credit

applied for, or a percentage of the credit to be issued by the

Department.

0405-355i Rev 07/13 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1