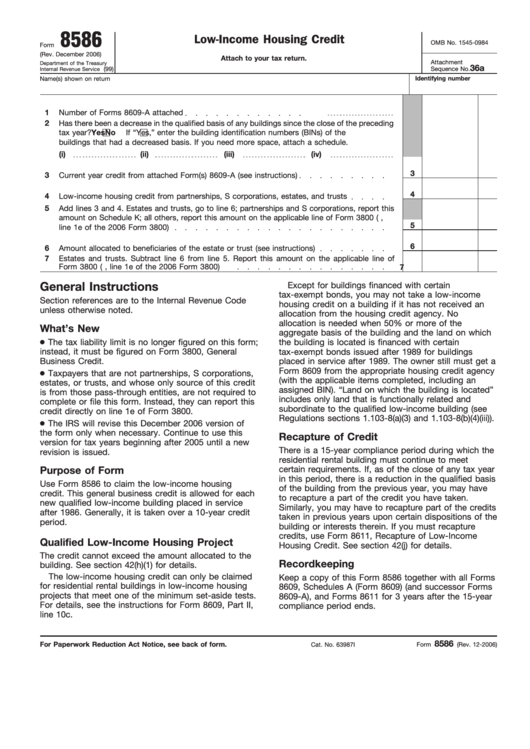

8586

Low-Income Housing Credit

OMB No. 1545-0984

Form

(Rev. December 2006)

Attach to your tax return.

Attachment

Department of the Treasury

36a

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

1

Number of Forms 8609-A attached

2

Has there been a decrease in the qualified basis of any buildings since the close of the preceding

tax year?

Yes

No

If “Yes,” enter the building identification numbers (BINs) of the

buildings that had a decreased basis. If you need more space, attach a schedule.

(i)

(ii)

(iii)

(iv)

3

3

Current year credit from attached Form(s) 8609-A (see instructions)

4

4

Low-income housing credit from partnerships, S corporations, estates, and trusts

5

Add lines 3 and 4. Estates and trusts, go to line 6; partnerships and S corporations, report this

amount on Schedule K; all others, report this amount on the applicable line of Form 3800 (e.g.,

5

line 1e of the 2006 Form 3800)

6

6

Amount allocated to beneficiaries of the estate or trust (see instructions)

7

Estates and trusts. Subtract line 6 from line 5. Report this amount on the applicable line of

Form 3800 (e.g., line 1e of the 2006 Form 3800)

7

General Instructions

Except for buildings financed with certain

tax-exempt bonds, you may not take a low-income

Section references are to the Internal Revenue Code

housing credit on a building if it has not received an

unless otherwise noted.

allocation from the housing credit agency. No

allocation is needed when 50% or more of the

What’s New

aggregate basis of the building and the land on which

The tax liability limit is no longer figured on this form;

the building is located is financed with certain

instead, it must be figured on Form 3800, General

tax-exempt bonds issued after 1989 for buildings

Business Credit.

placed in service after 1989. The owner still must get a

Form 8609 from the appropriate housing credit agency

Taxpayers that are not partnerships, S corporations,

(with the applicable items completed, including an

estates, or trusts, and whose only source of this credit

assigned BIN). “Land on which the building is located”

is from those pass-through entities, are not required to

includes only land that is functionally related and

complete or file this form. Instead, they can report this

subordinate to the qualified low-income building (see

credit directly on line 1e of Form 3800.

Regulations sections 1.103-8(a)(3) and 1.103-8(b)(4)(iii)).

The IRS will revise this December 2006 version of

the form only when necessary. Continue to use this

Recapture of Credit

version for tax years beginning after 2005 until a new

There is a 15-year compliance period during which the

revision is issued.

residential rental building must continue to meet

Purpose of Form

certain requirements. If, as of the close of any tax year

in this period, there is a reduction in the qualified basis

Use Form 8586 to claim the low-income housing

of the building from the previous year, you may have

credit. This general business credit is allowed for each

to recapture a part of the credit you have taken.

new qualified low-income building placed in service

Similarly, you may have to recapture part of the credits

after 1986. Generally, it is taken over a 10-year credit

taken in previous years upon certain dispositions of the

period.

building or interests therein. If you must recapture

credits, use Form 8611, Recapture of Low-Income

Qualified Low-Income Housing Project

Housing Credit. See section 42(j) for details.

The credit cannot exceed the amount allocated to the

Recordkeeping

building. See section 42(h)(1) for details.

The low-income housing credit can only be claimed

Keep a copy of this Form 8586 together with all Forms

for residential rental buildings in low-income housing

8609, Schedules A (Form 8609) (and successor Forms

projects that meet one of the minimum set-aside tests.

8609-A), and Forms 8611 for 3 years after the 15-year

For details, see the instructions for Form 8609, Part II,

compliance period ends.

line 10c.

8586

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 63987I

Form

(Rev. 12-2006)

1

1 2

2