Form Ptax-337-R - Combined Application For Conservation Right Public Benefit Certification And For Reduced Assessed Valuation Of Property Page 2

ADVERTISEMENT

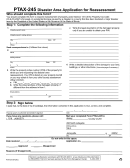

Instructions

You may request a reduced assessed valuation of the property

appear in the registration agreement or the attached conservation

described on Part 1 by completing and filing Part 3 and Part 4 of this

right for encumbered land under Part 1.

notarized application with the chief county assessment officer in the

A separate application must be filed with the chief county assess-

county where registered land (525 ILCS 30/16) or certified land

ment officer in each county where the listed property is located for

encumbered by a conservation right that provides a demonstrated

which you are seeking a reduced assessed valuation. The application

public benefit (35 ILCS 200/10-167) is located.

must be submitted by January 31 of the tax assessment year for

You must attach a copy of the entire recorded registration agreement

which a reduced assessed valuation is sought.

if the property listed on this notarized application is registered land.

A complete legal description of the listed property should

Part 3: Provide requested information

I am the person or entity liable for taxes on the property listed on Part

Under Section 10-169 of the Property Tax Code (35 ILCS 200/10-169),

1 of this application which is located in __________________

the person or entity liable for taxes on the listed property shall notify

County, Illinois.

the chief county assessment officer in writing by certified mail within

30 days after the release or amendment of either the registration

I am filing this application to request a reduced assessment of the

agreement or the conservation right if the effect is to substantially

listed property for the reason indicated below.

diminish the public benefit. The person or entity liable for taxes is

Please check only one reason.

required to pay the county treasurer the difference in taxes based on

The conservation right on the listed property has been certified

the fair market value or ordinance level of the property permitted by

as providing a demonstrated public benefit (35 ILCS 200/10-167).

law in each of the 10 preceding years or lesser time period the

See reverse side for IDNR certification.

reduced valuation was in effect, plus 10 percent interest. Payment is

The listed property has been registered under the Illinois

due by the following September 1 or the amount of the difference

Natural Areas Preservation Act (525 ILCS 30/16).

shall be considered delinquent taxes.

The registration agreement or conservation right establishes a

Except as otherwise provided in Section 10-169(b) of the Property

perpetual encumbrance on the listed property.

Tax Code (35 ILCS 200/10-169(b)), if a written notice is not provided

by certified mail in a timely manner, then any property that is no

The registration agreement or conservation right prohibits the

longer registered or encumbered by the conservation right shall be

construction of any other structure on the listed property except for

treated as omitted property under this Code.

replacement structures of a similar or smaller size that do not

interfere with or destroy the registration or conservation right.

Part 4: Sign below

The listed property has not been valued as open space land under

Section 10-155 of the Property Tax Code (35 ILCS 200/10-155).

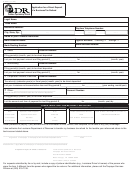

Under penalties of perjury, I state that, to the best of my knowledge,

the information contained in this application, including attached

If this application is approved, I understand: Under Section 10-166 of

material, is true, correct, and complete. I agree to abide by all

the Property Tax Code (35 ILCS 200/10-166), in counties with

provisions in the registration agreement or the conservation right on

200,000 or fewer inhabitants that do not classify property for the

the listed property. I further agree to comply with all requirements

purpose of taxation, the listed property shall be valued at

relating to the reduced assessed valuation for registered land or land

8 1/3 percent of its fair market value, estimated as if the property was

encumbered by conservation rights under Article 10 of the Property

not registered or encumbered. Any improvement on the property

Tax Code.

shall be valued at 33 1/3 percent of its fair market value.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Under Section 10-166 of the Property Tax Code (35 ILCS 200/10-166),

Applicant's signature

Date

in counties with more than 200,000 inhabitants that classify property

for the purpose of taxation, the listed property shall be valued at

Subscribed and sworn to before me this

25 percent of that percentage of its fair market value established by

____ day of ______________, 200____.

an ordinance adopted under Section 4 of Article IX of the Illinois

Constitution of 1970. Any improvement on the property shall be

valued at that percentage of fair market value established by the

_____________________________________________

same ordinance.

Notary public

If you have any questions, please call:

For use by chief county assessment officer (CCAO)

(______)____________________________

Date Received ___ ___/___ ___/___ ___ ___ ___

Mail your completed Form PTAX-337-R to:

Approved

Disapproved

___________________________________ County CCAO

Reasons (if disapproved)

________________________________

_________________________________________________

___________________________________________________

Mailing address

_________________________________________________

_____________________________________________

Chief county assessment officer's signature

Date

__________________________________ IL ____________

PTAX-337-R back (R-04/02)

City

ZIP

IL-492-3461

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2