MEMORANDUM

To:

All taxpayers with properties that suffered damage due to the floods of July, 2017

From:

Larry Wilson, Rock Island County Supervisor of Assessments

Date:

August 1, 2017

Re:

Property Tax Relief for Flood Damaged Structures

The Rock Island County Assessment Office is beginning the process of reassessing

properties damaged by the floods of July, 2017.

Illinois Governor Bruce Rauner has declared Rock Island County to be a major disaster

area, which triggers the disaster area reassessment provisions of the Illinois Property Tax

Code.

This Disaster Area Reassessment provides that upon the declaration of a disaster area,

any portion of real property that was “substantially damaged by the disaster” may be

eligible for reassessment upon the filing of an application with the Rock Island County

Assessment Office.

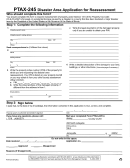

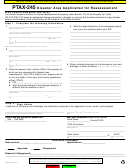

Taxpayers who believe they may be eligible for reassessment should fill out the attached

form and return it to the Rock Island County Assessment Office, which will then forward

the application to the respective Township Assessors.

The Township Assessors may contact applicants in order to evaluate the

claims; persons filing for disaster area reassessment should be prepared to show their

Township Assessor evidence of the loss in the form of receipts, insurance claims,

photographs, or other evidence.

Those properties qualifying for a revised assessment will have their assessments adjusted

on a pro rata basis for the period from July 24th through the end of the year, as provided

by law.

Questions regarding this application should be directed to the Rock Island County

Assessment Office at (309) 558-3660.

Thank you.

1

1 2

2