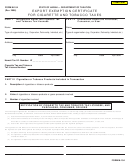

FORM G-61

INSTRUCTIONS

(REV. 2009)

PAGE 2

General Information

user who are signatories to the certifi-

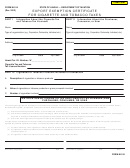

Part II

cate. Failure to provide the export ex-

Section 237-29.5, Hawaii Revised Stat-

Enter information regarding the pur-

emption certificate (Form G-61) or an

utes (HRS), exempts from the general

chaser, consumer, or user.

equivalent certification as required un-

excise tax, the value or gross proceeds

der Sections 237-29.5, 237-29.53, and

Part III

arising from the manufacture, produc-

244D-4.3, HRS, will result in the disal-

tion, or sale of tangible personal prop-

Enter information regarding the tangi-

lowance of the exemption. In the event

erty shipped by the manufacturer, pro-

ble personal property, contracting, ser-

the Form G-61 is impracticable to com-

ducer, or seller to a point outside the

vices, or liquor involved in this transac-

plete, an alternative form or document

State where the property is resold or

tion.

may be used provided the information

otherwise consumed or used outside

requested in Parts I, II, and III of the

Signing of the Certificate

the State. See Tax Information Re-

Form G-61 are maintained.

lease No. 98-5 for more information.

The certificate shall be dated, execut-

ed, and signed by both the provider,

General Instructions

Section 237-29.53, HRS, exempts from

and the purchaser, consumer, or user.

the general excise tax, the value or

The provider who is claiming the export

gross proceeds arising from contract-

exemption under sections 237-29.5,

Where to File

ing or services by a contractor, service

237-29.53, and/or 244D-4.3, HRS,

The certificate must be retained at the

provider, or seller that is resold, or oth-

must inform the purchaser, consumer,

provider’s place of business.

erwise consumed or used outside the

or user that the purchaser, consumer,

State. Contracting is considered to be

or user is obtaining property/contract-

Where to Get Forms,

consumed or used in the locale where

ing/services/liquor for which the pro-

Instructions, and Publications

the real property to which the contract-

vider will claim a tax exemption.

Forms, publications, and other docu-

ing relates is situated. See Tax Infor-

ments, such as copies of Tax Informa-

The purchaser, consumer, or user is

mation Release No. 2009-02 for more

tion Releases and Administrative Rules

required to notify the provider if the

information.

issued by the Department, are avail-

property/contracting/services/liquor will

Section 244D-4.3, HRS, exempts from

able on the Department’s website at

not be resold, consumed, or used out-

the liquor tax, the value or gross pro-

or you may con-

side the State.

ceeds arising from the manufacture,

tact the customer service staff of our

If

the

property/contracting/services/

production, or sale of liquor shipped by

Taxpayer Services Branch at:

liquor purchased is not resold or oth-

the manufacturer, producer, or seller to

Voice: 808-587-4242

erwise consumed or used outside the

a point outside the State where the li-

1-800-222-3229 (Toll-Free)

State, the provider must remit to the

quor is resold or otherwise consumed

Department the tax due on the proper-

or used outside the State.

Telephone for the Hearing Impaired:

ty/contracting/services/liquor for which

808-587-1418

Purpose of This Certificate

the export exemption was claimed. The

1-800-887-8974 (Toll-Free)

purchaser, upon demand, shall be obli-

Form G-61, Export Exemption Certifi-

Fax:

808-587-1488

gated to pay to the provider the amount

cate, must be completed in order for

of the additional tax imposed upon the

the manufacturer, producer, contractor,

E-mail: Taxpayer.Services@hawaii.gov

provider.

service provider, or seller (provider) to

Mail:

Taxpayer Services Branch

claim an exemption from general ex-

Specific Instructions

P.O. Box 259

cise and/or liquor taxes under Sections

Honolulu, HI 96809-0259

Part I

237-29.5, 237-29.53, or 244D-4.3,

HRS. This form must be a part of each

Enter information regarding the manu-

order or contract of sale between the

facturer, producer, contractor, service

provider and purchaser, consumer, or

provider or seller.

1

1 2

2