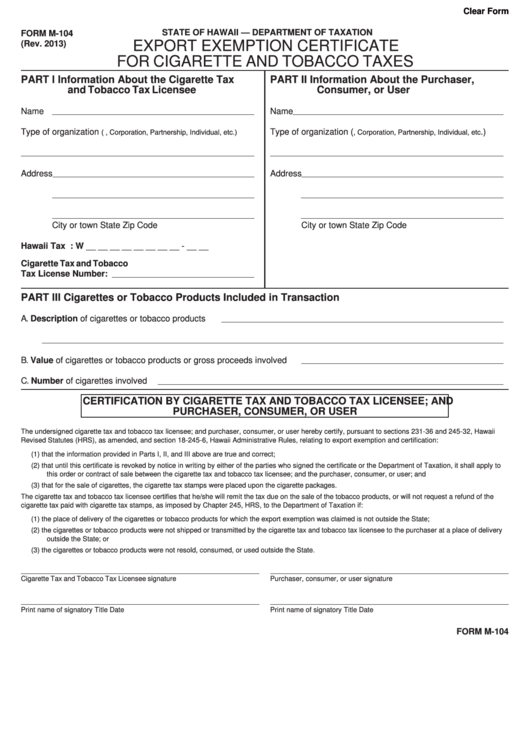

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM M-104

EXPORT EXEMPTION CERTIFICATE

(Rev. 2013)

FOR CIGARETTE AND TOBACCO TAXES

PART I

Information About the Cigarette Tax

PART II

Information About the Purchaser,

and Tobacco Tax Licensee

Consumer, or User

Name

Name

Type of organization (e.g., Corporation, Partnership, Individual, etc.)

Type of organization (e.g., Corporation, Partnership, Individual, etc.)

Address

Address

City or town

State

Zip Code

City or town

State

Zip Code

Hawaii Tax I.D. Number: W __ __ __ __ __ __ __ __ - __ __

Cigarette Tax and Tobacco

Tax License Number:

PART III Cigarettes or Tobacco Products Included in Transaction

A.

Description of cigarettes or tobacco products

B.

Value of cigarettes or tobacco products or gross proceeds involved

C.

Number of cigarettes involved

CERTIFICATION BY CIGARETTE TAX AND TOBACCO TAX LICENSEE; AND

PURCHASER, CONSUMER, OR USER

The undersigned cigarette tax and tobacco tax licensee; and purchaser, consumer, or user hereby certify, pursuant to sections 231-36 and 245-32, Hawaii

Revised Statutes (HRS), as amended, and section 18-245-6, Hawaii Administrative Rules, relating to export exemption and certification:

(1) that the information provided in Parts I, II, and III above are true and correct;

(2) that until this certificate is revoked by notice in writing by either of the parties who signed the certificate or the Department of Taxation, it shall apply to

this order or contract of sale between the cigarette tax and tobacco tax licensee; and the purchaser, consumer, or user; and

(3) that for the sale of cigarettes, the cigarette tax stamps were placed upon the cigarette packages.

The cigarette tax and tobacco tax licensee certifies that he/she will remit the tax due on the sale of the tobacco products, or will not request a refund of the

cigarette tax paid with cigarette tax stamps, as imposed by Chapter 245, HRS, to the Department of Taxation if:

(1) the place of delivery of the cigarettes or tobacco products for which the export exemption was claimed is not outside the State;

(2) the cigarettes or tobacco products were not shipped or transmitted by the cigarette tax and tobacco tax licensee to the purchaser at a place of delivery

outside the State; or

(3) the cigarettes or tobacco products were not resold, consumed, or used outside the State.

Cigarette Tax and Tobacco Tax Licensee signature

Purchaser, consumer, or user signature

Print name of signatory

Title

Date

Print name of signatory

Title

Date

FORM M-104

1

1 2

2