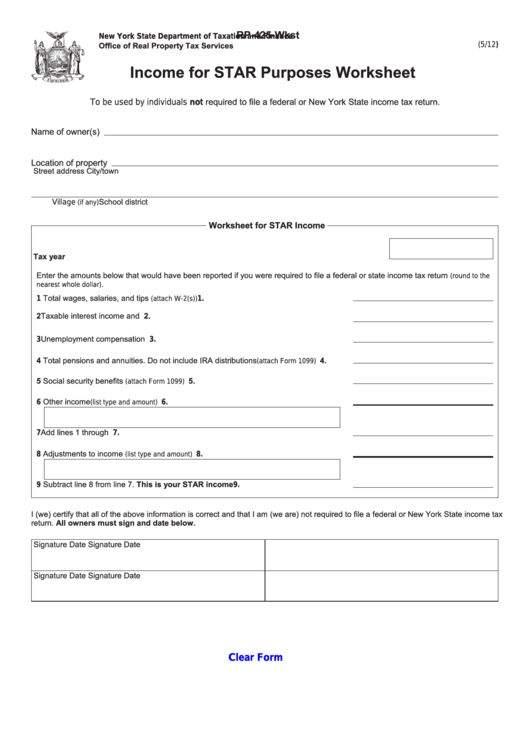

RP-425-Wkst

New York State Department of Taxation and Finance

Office of Real Property Tax Services

(5/12)

Income for STAR Purposes Worksheet

To be used by individuals not required to file a federal or New York State income tax return.

Name of owner(s)

Location of property

Street address

City/town

School district

Village

(if any)

Worksheet for STAR Income

Tax year

Enter the amounts below that would have been reported if you were required to file a federal or state income tax return

(round to the

.

nearest whole dollar)

1 Total wages, salaries, and tips

................................................................. 1.

(attach W-2(s))

2 Taxable interest income and dividends........................................................................... 2.

3 Unemployment compensation ........................................................................................ 3.

4 Total pensions and annuities. Do not include IRA distributions

4.

(attach Form 1099) ............

5 Social security benefits

5.

(attach Form 1099) ................................................................................

6 Other income

6.

(list type and amount) .............................................................................................

7 Add lines 1 through 6...................................................................................................... 7.

8 Adjustments to income

8.

(list type and amount) ............................................................................

9 Subtract line 8 from line 7. This is your STAR income ................................................ 9.

I (we) certify that all of the above information is correct and that I am (we are) not required to file a federal or New York State income tax

return. All owners must sign and date below.

Signature

Date

Signature

Date

Signature

Date

Signature

Date

Clear Form

1

1