Form Mts2 - Severance Tax Schedule Oil Well Incentive Reporting - 2002 Page 2

ADVERTISEMENT

Severance Tax Form Instructions

6WDWH RI :\RPLQJ

2002

SEVERANCE TAX SCHEDULE

'HSDUWPHQW RI 5HYHQXH

:HVW WK 6WUHHW

Oil Well Incentive Reporting

&KH\HQQH :<

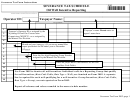

DEPARTMENT OF REVENUE USE ONLY:

Operator ID:

Taxpayer Name:

API NUMBER

:(//

6,'(75$&.

5(6(592,5

352'8&7,21

5(3257,1*

5$7(

&2817<

180%(5

180%(5

180%(5

*5266 6$/(6 92/80(

*5266 6$/(6 9$/8(

7$;$%/( 9$/8(

3(5,2'

*5283

&2'(

180%(5

PP\\\\

180%(5

1

2

Enter the complete API Number of each qualifying well as assigned

3

by the Wyoming Oil and Gas Conservation Commission. The API

4

Number consists of County Number, Well Number, Side Track

Number, and Reservoir Number.

5

6

Operators, enter barrels sold for each well, after deducting

barrels taken in-kind by interest owners who are reporting on

7

their own behalf. Take in-kind interest owners enter barrels

8

taken in-kind for each well.

9

Enter the gross sales value for the well for the production period.

10

Gross Sales Value includes all revenue relating to the production for

11

the reported period, including tax reimbursements and all other

revenue received or credited to all interest owners not taking in-kind

12

and reporting on their own behalf, and including all Federal, State, or

Tribal royalty owner's interest.

13

14

The taxable value equals the gross sales value for the well less any exempt royalty and transportation for the well.

Severance Tax Form 2002; page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4