Form Mts2 - Severance Tax Schedule Oil Well Incentive Reporting - 2002 Page 3

ADVERTISEMENT

Severance Tax Form Instructions

6WDWH RI :\RPLQJ

2002

SEVERANCE TAX SCHEDULE

'HSDUWPHQW RI 5HYHQXH

:HVW WK 6WUHHW

Oil Well Incentive Reporting

&KH\HQQH :<

DEPARTMENT OF REVENUE USE ONLY:

Operator ID:

Taxpayer Name:

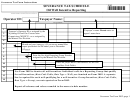

Severance Well Rate Code Table for Oil (as of 1/1/2002)

Rate

Mineral

Rate

API NUMBER

352'8&7,21

5(3257,1*

5$7(

&2817<

:(//

6,'(75$&.

5(6(592,5

Code

Type

Description

3(5,2'

*5283

&2'(

180%(5

180%(5

180%(5

180%(5

*5266 6$/(6 92/80(

*5266 6$/(6 9$/8(

7$;$%/( 9$/8(

WRK

Oil

Well

Workover - Incremental

PP\\\\

180%(5

1

REC

Oil

Well

Recompletion - Incremental

NEW

Oil

Well

New Well

2

WLD

Oil

Well

Wildcat

3

COL

Oil

Well

Collection Well

REN

Oil

Well

Renewed Production

4

5

The cumulative total of all qualifying wells listed on Form 2002 for a particular Production Period, Reporting

6

Group Number, and Rate Code must total to Form 2000 for the same Production Period, Reporting Group Number,

and Rate Code.

7

8

The mailing address for all Department of Revenue mineral forms is:

9

Wyoming Department of Revenue

10

Mineral Tax Division

122 West 25th Street

11

Cheyenne, WY 82002-0110

12

13

All paper forms must be signed and dated originals.

I declare under penalty of perjury that I have examined this return and, to the best of my knowledge and belief, it is correct and complete.

Authorized Signature

Title

Date

MTS2 12/16/99

Severance Tax Form 2002; page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4