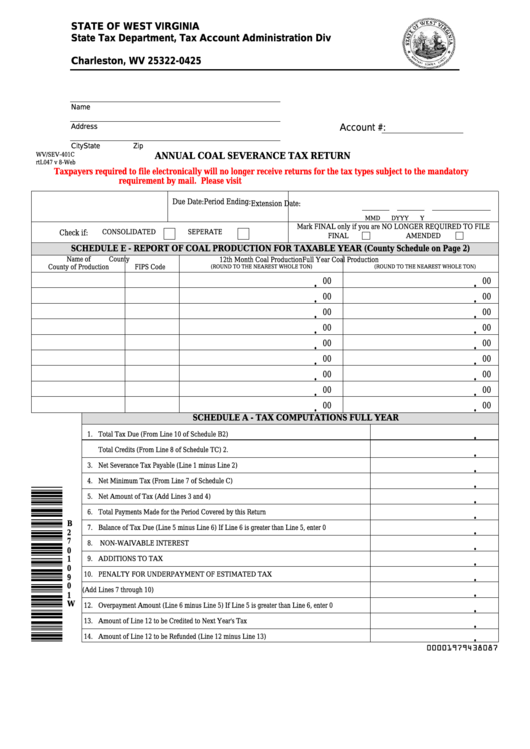

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address

Account #:

City

State

Zip

WV/SEV-401C

ANNUAL COAL SEVERANCE TAX RETURN

rtL047 v 8-Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory

requirement by mail. Please visit for additional information.

Period Ending:

Due Date:

Extension Date:

M

M

D

D

Y

Y

Y

Y

Mark FINAL only if you are NO LONGER REQUIRED TO FILE

Check if:

CONSOLIDATED

SEPERATE

FINAL

AMENDED

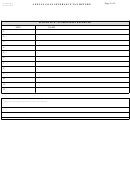

SCHEDULE E - REPORT OF COAL PRODUCTION FOR TAXABLE YEAR (County Schedule on Page 2)

Name of

County

12th Month Coal Production

Full Year Coal Production

(ROUND TO THE NEAREST WHOLE TON)

(ROUND TO THE NEAREST WHOLE TON)

County of Production

FIPS Code

00

00

.

.

.

00

.

00

00

00

.

.

00

00

.

.

.

00

.

00

00

00

.

.

00

00

.

.

00

00

.

.

.

00

.

00

SCHEDULE A - TAX COMPUTATIONS FULL YEAR

.

1.

Total Tax Due (From Line 10 of Schedule B2)

2.

Total Credits (From Line 8 of Schedule TC)

.

3.

Net Severance Tax Payable (Line 1 minus Line 2)

.

4.

Net Minimum Tax (From Line 7 of Schedule C)

.

5.

Net Amount of Tax (Add Lines 3 and 4)

.

6.

Total Payments Made for the Period Covered by this Return

.

B

7.

Balance of Tax Due (Line 5 minus Line 6) If Line 6 is greater than Line 5, enter 0

.

2

7

8.

NON-WAIVABLE INTEREST

.

0

1

9.

ADDITIONS TO TAX

.

0

10.

PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

.

9

0

11. TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 7 through 10)

.

1

W

12.

Overpayment Amount (Line 6 minus Line 5) If Line 5 is greater than Line 6, enter 0

.

13.

Amount of Line 12 to be Credited to Next Year's Tax

.

.

14.

Amount of Line 12 to be Refunded (Line 12 minus Line 13)

00001979438087

1

1 2

2 3

3 4

4