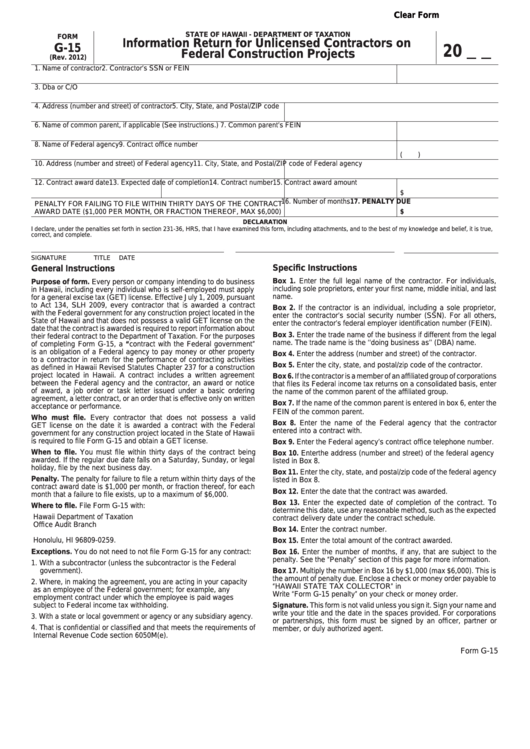

Clear Form

STATE OF HAWAII - DEPARTMENT OF TAXATION

FORM

Information Return for Unlicensed Contractors on

G-15

20

Federal Construction Projects

(Rev. 2012)

1. Name of contractor

2. Contractor’s SSN or FEIN

3. Dba or C/O

4. Address (number and street) of contractor

5. City, State, and Postal/ZIP code

6. Name of common parent, if applicable (See instructions.)

7. Common parent’s FEIN

8. Name of Federal agency

9. Contract office number

(

)

10. Address (number and street) of Federal agency

11. City, State, and Postal/ZIP code of Federal agency

12. Contract award date

13. Expected date of completion

14. Contract number

15. Contract award amount

$

16. Number of months

17. PENALTY DUE

PENALTY FOR FAILING TO FILE WITHIN THIRTY DAYS OF THE CONTRACT

AWARD DATE ($1,000 PER MONTH, OR FRACTION THEREOF, MAX $6,000)

$

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that I have examined this form, including attachments, and to the best of my knowledge and belief, it is true,

correct, and complete.

SIGNATURE

TITLE

DATE

Specific Instructions

General Instructions

Box 1. Enter the full legal name of the contractor. For individuals,

Purpose of form. Every person or company intending to do business

including sole proprietors, enter your first name, middle initial, and last

in Hawaii, including every individual who is self-employed must apply

name.

for a general excise tax (GET) license. Effective July 1, 2009, pursuant

to Act 134, SLH 2009, every contractor that is awarded a contract

Box 2. If the contractor is an individual, including a sole proprietor,

with the Federal government for any construction project located in the

enter the contractor’s social security number (SSN). For all others,

State of Hawaii and that does not possess a valid GET license on the

enter the contractor’s federal employer identification number (FEIN).

date that the contract is awarded is required to report information about

Box 3. Enter the trade name of the business if different from the legal

their federal contract to the Department of Taxation. For the purposes

name. The trade name is the ‘‘doing business as’’ (DBA) name.

of completing Form G-15, a “contract with the Federal government”

is an obligation of a Federal agency to pay money or other property

Box 4. Enter the address (number and street) of the contractor.

to a contractor in return for the performance of contracting activities

Box 5. Enter the city, state, and postal/zip code of the contractor.

as defined in Hawaii Revised Statutes Chapter 237 for a construction

project located in Hawaii. A contract includes a written agreement

Box 6. If the contractor is a member of an affiliated group of corporations

between the Federal agency and the contractor, an award or notice

that files its Federal income tax returns on a consolidated basis, enter

of award, a job order or task letter issued under a basic ordering

the name of the common parent of the affiliated group.

agreement, a letter contract, or an order that is effective only on written

Box 7. If the name of the common parent is entered in box 6, enter the

acceptance or performance.

FEIN of the common parent.

Who must file. Every contractor that does not possess a valid

Box 8. Enter the name of the Federal agency that the contractor

GET license on the date it is awarded a contract with the Federal

entered into a contract with.

government for any construction project located in the State of Hawaii

is required to file Form G-15 and obtain a GET license.

Box 9. Enter the Federal agency’s contract office telephone number.

When to file. You must file within thirty days of the contract being

Box 10. Enter the address (number and street) of the federal agency

awarded. If the regular due date falls on a Saturday, Sunday, or legal

listed in Box 8.

holiday, file by the next business day.

Box 11. Enter the city, state, and postal/zip code of the federal agency

Penalty. The penalty for failure to file a return within thirty days of the

listed in Box 8.

contract award date is $1,000 per month, or fraction thereof, for each

Box 12. Enter the date that the contract was awarded.

month that a failure to file exists, up to a maximum of $6,000.

Box 13. Enter the expected date of completion of the contract. To

Where to file. File Form G-15 with:

determine this date, use any reasonable method, such as the expected

Hawaii Department of Taxation

contract delivery date under the contract schedule.

Office Audit Branch

Box 14. Enter the contract number.

P.O. Box 259

Honolulu, HI 96809-0259.

Box 15. Enter the total amount of the contract awarded.

Exceptions. You do not need to not file Form G-15 for any contract:

Box 16. Enter the number of months, if any, that are subject to the

penalty. See the “Penalty” section of this page for more information.

1. With a subcontractor (unless the subcontractor is the Federal

government).

Box 17. Multiply the number in Box 16 by $1,000 (max $6,000). This is

the amount of penalty due. Enclose a check or money order payable to

2. Where, in making the agreement, you are acting in your capacity

“HAWAII STATE TAX COLLECTOR” in U.S. dollars with Form G-15.

as an employee of the Federal government; for example, any

Write “Form G-15 penalty” on your check or money order.

employment contract under which the employee is paid wages

subject to Federal income tax withholding.

Signature. This form is not valid unless you sign it. Sign your name and

write your title and the date in the spaces provided. For corporations

3. With a state or local government or agency or any subsidiary agency.

or partnerships, this form must be signed by an officer, partner or

4. That is confidential or classified and that meets the requirements of

member, or duly authorized agent.

Internal Revenue Code section 6050M(e).

Form G-15

1

1