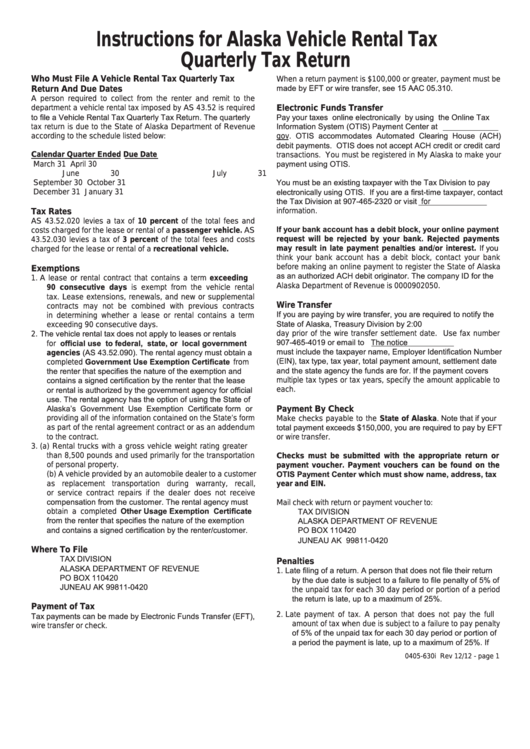

Instructions For Alaska Vehicle Rental Tax Quarterly Tax Return

ADVERTISEMENT

Instructions for Alaska Vehicle Rental Tax

Quarterly Tax Return

Who Must File A Vehicle Rental Tax Quarterly Tax

When a return payment is $100,000 or greater, payment must be

made by EFT or wire transfer, see 15 AAC 05.310.

Return And Due Dates

A person required to collect from the renter and remit to the

department a vehicle rental tax imposed by AS 43.52 is required

Electronic Funds Transfer

to file a Vehicle Rental Tax Quarterly Tax Return. The quarterly

Pay your taxes online electronically by using the Online Tax

Information System (OTIS) Payment Center at

tax return is due to the State of Alaska Department of Revenue

gov. OTIS accommodates Automated Clearing House (ACH)

according to the schedule listed below:

debit payments. OTIS does not accept ACH credit or credit card

Calendar Quarter Ended Due Date

transactions. You must be registered in My Alaska to make your

payment using OTIS.

March 31

April 30

June 30

July 31

You must be an existing taxpayer with the Tax Division to pay

September 30

October 31

electronically using OTIS. If you are a first-time taxpayer, contact

December 31

January 31

the Tax Division at 907-465-2320 or visit gov for

information.

Tax Rates

AS 43.52.020 levies a tax of 10 percent of the total fees and

If your bank account has a debit block, your online payment

costs charged for the lease or rental of a passenger vehicle. AS

request will be rejected by your bank. Rejected payments

43.52.030 levies a tax of 3 percent of the total fees and costs

may result in late payment penalties and/or interest. If you

charged for the lease or rental of a recreational vehicle.

think your bank account has a debit block, contact your bank

before making an online payment to register the State of Alaska

Exemptions

as an authorized ACH debit originator. The company ID for the

1.

A lease or rental contract that contains a term exceeding

Alaska Department of Revenue is 0000902050.

90 consecutive days is exempt from the vehicle rental

tax. Lease extensions, renewals, and new or supplemental

Wire Transfer

contracts may not be combined with previous contracts

If you are paying by wire transfer, you are required to notify the

in determining whether a lease or rental contains a term

State of Alaska, Treasury Division by 2:00 p.m. the business

exceeding 90 consecutive days.

The vehicle rental tax does not apply to leases or rentals

day prior of the wire transfer settlement date. Use fax number

2.

907-465-4019 or email to cashmgmt@alaska.gov. The notice

for official use to federal, state, or local government

must include the taxpayer name, Employer Identification Number

agencies (AS 43.52.090). The rental agency must obtain a

(EIN), tax type, tax year, total payment amount, settlement date

completed Government Use Exemption Certificate from

and the state agency the funds are for. If the payment covers

the renter that specifies the nature of the exemption and

contains a signed certification by the renter that the lease

multiple tax types or tax years, specify the amount applicable to

or rental is authorized by the government agency for official

each.

use. The rental agency has the option of using the State of

Alaska’s Government Use Exemption Certificate form or

Payment By Check

Make checks payable to the State of Alaska. Note that if your

providing all of the information contained on the State’s form

total payment exceeds $150,000, you are required to pay by EFT

as part of the rental agreement contract or as an addendum

to the contract.

or wire transfer.

3.

(a) Rental trucks with a gross vehicle weight rating greater

than 8,500 pounds and used primarily for the transportation

Checks must be submitted with the appropriate return or

of personal property.

payment voucher. Payment vouchers can be found on the

OTIS Payment Center which must show name, address, tax

(b) A vehicle provided by an automobile dealer to a customer

as replacement transportation during warranty, recall,

year and EIN.

or service contract repairs if the dealer does not receive

compensation from the customer. The rental agency must

Mail check with return or payment voucher to:

obtain a completed Other Usage Exemption Certificate

TAX DIVISION

from the renter that specifies the nature of the exemption

ALASKA DEPARTMENT OF REVENUE

and contains a signed certification by the renter/customer.

PO BOX 110420

JUNEAU AK 99811-0420

Where To File

TAX DIVISION

Penalties

ALASKA DEPARTMENT OF REVENUE

Late filing of a return. A person that does not file their return

1.

PO BOX 110420

by the due date is subject to a failure to file penalty of 5% of

JUNEAU AK 99811-0420

the unpaid tax for each 30 day period or portion of a period

the return is late, up to a maximum of 25%.

Payment of Tax

Tax payments can be made by Electronic Funds Transfer (EFT),

2.

Late payment of tax. A person that does not pay the full

amount of tax when due is subject to a failure to pay penalty

wire transfer or check.

of 5% of the unpaid tax for each 30 day period or portion of

a period the payment is late, up to a maximum of 25%. If

0405-630i Rev 12/12 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2