Instructions For Form 44 Use Tax Return For Consumers & Non-Licensed Businesses - Wyoming Department Of Revenue

ADVERTISEMENT

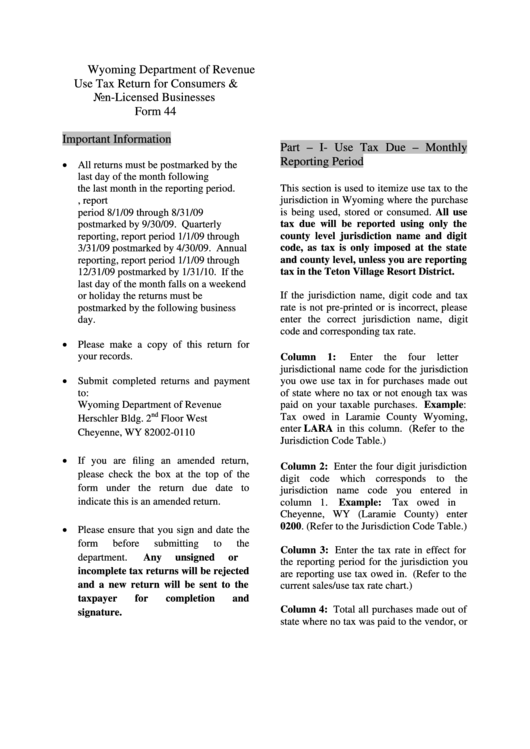

Wyoming Department of Revenue

Use Tax Return for Consumers &

Non-Licensed Businesses

Form 44

Important Information

Part – I- Use Tax Due – Monthly

Reporting Period

All returns must be postmarked by the

last day of the month following

This section is used to itemize use tax to the

the last month in the reporting period.

jurisdiction in Wyoming where the purchase

i.e. If you are reporting monthly, report

is being used, stored or consumed. All use

period 8/1/09 through 8/31/09

tax due will be reported using only the

postmarked by 9/30/09. Quarterly

reporting, report period 1/1/09 through

county level jurisdiction name and digit

code, as tax is only imposed at the state

3/31/09 postmarked by 4/30/09. Annual

reporting, report period 1/1/09 through

and county level, unless you are reporting

tax in the Teton Village Resort District.

12/31/09 postmarked by 1/31/10. If the

last day of the month falls on a weekend

If the jurisdiction name, digit code and tax

or holiday the returns must be

rate is not pre-printed or is incorrect, please

postmarked by the following business

enter the correct jurisdiction name, digit

day.

code and corresponding tax rate.

Please make a copy of this return for

your records.

Column

1:

Enter

the

four

letter

jurisdictional name code for the jurisdiction

Submit completed returns and payment

you owe use tax in for purchases made out

to:

of state where no tax or not enough tax was

Wyoming Department of Revenue

paid on your taxable purchases. Example:

nd

Tax owed in Laramie County Wyoming,

Herschler Bldg. 2

Floor West

enter LARA in this column. (Refer to the

Cheyenne, WY 82002-0110

Jurisdiction Code Table.)

If you are filing an amended return,

Column 2: Enter the four digit jurisdiction

please check the box at the top of the

digit code which corresponds to the

form under the return due date to

jurisdiction name code you entered in

indicate this is an amended return.

column 1.

Example:

Tax owed in

Cheyenne, WY (Laramie County) enter

0200. (Refer to the Jurisdiction Code Table.)

Please ensure that you sign and date the

form

before

submitting

to

the

Column 3: Enter the tax rate in effect for

department.

Any

unsigned

or

the reporting period for the jurisdiction you

incomplete tax returns will be rejected

are reporting use tax owed in. (Refer to the

and a new return will be sent to the

current sales/use tax rate chart.)

taxpayer

for

completion

and

Column 4: Total all purchases made out of

signature.

state where no tax was paid to the vendor, or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3