Form Dr-309631 Draft - Terminal Supplier Fuel Tax Return - 2018 Page 17

ADVERTISEMENT

00009

DR-309631

Check here if filing a supplemental schedule

R. 01/14

Page 17

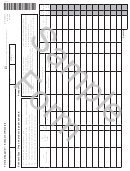

Schedule 13B — EFT bad debt credits worksheet for reporting credits of uncollected taxes paid on fuel sold to

wholesalers. Credits accrue when failed EFT tax payments are reported to the Department within 10 days.

Schedule

Company Name

FEIN

Collection Period Ending

(mm/dd/yy)

13B

GALLONS

DIESEL

A. Gasoline

B. Undyed

C. Dyed

D. Aviation

1.

Total gallons qualifying for credit: ........................

2.

State fuel tax rate: ...............................................

.31425

.177

.069

3.

State tax due: (Line 1 times Line 2) .....................

4.

Collection allowance - state tax: .........................

.00323

.0067

.002

5.

State tax collection allowance calculation:

(Line 4 times Line 3) ............................................

6.

Portion of local option tax rate entitled to

.07

collection allowance: ...........................................

7.

Portion of local option tax entitled to collection

allowance: (Line 1 times Line 6) ..........................

.011

8.

Local option tax collection allowance rate: .........

9.

Local option tax collection allowance:

(Line 8 times Line 7) ............................................

10. Portion of local option rate not entitled to

.076

collection allowance: ...........................................

11. Portion of local option tax not entitled to

collection allowance: (Line 1 times Line 10) ........

Failed EFT Credit Calculation

12. Gasoline: (Line 3 minus Line 5) ...........................

13. Diesel: (Line 3 minus Line 5 plus Line 7 minus

Line 9 plus Line 11) .............................................

14. Aviation:

(Line 3 minus Line 5) ...........................................

15. Total failed EFT credit amount: (Line 12 plus Line 13 plus Line 14. Carry to Page 3, Line 29.) .......................................

You must complete Schedule 13F (Pages 15 and 16) and Schedule 13B (Page17) and attach both

schedules to your return to qualify for this credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18