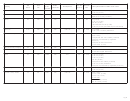

Form Dr 1250 - History Of Local Sales/use Taxes Page 16

ADVERTISEMENT

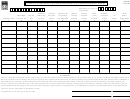

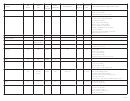

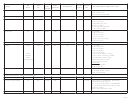

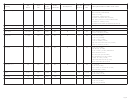

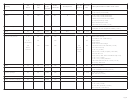

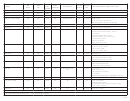

Date Tax

Tax

Use

State

Use Tax

Service

Locality

First

Exemptions

County Distributions/Other Comments

Rate

Tax

Collected

Covers

Fee

Imposed

Gunnison County Lodging

0%

1/1/91

Yes

1.9% to 4% (07/01/03)

Becomes Local Marketing District Tax (1/1/08)

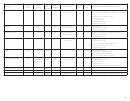

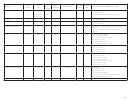

Gunnison

4%

Yes

9/1/63

No

W

W

5%

1% (9/1/63)

Use Tax 1% (1/1/80)

1% to 2% (1/1/80) Sales/Use

2% to 3% (7/1/83) Sales/Use

Self collected (7/1/01)

3% to 4% (7/1/07)

Gunnison Valley RTA (See RTA - Gunnison Valley)

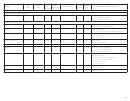

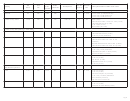

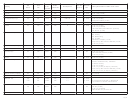

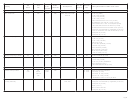

Gypsum

3%

Yes

1/1/77

No

W

W

3 1/3%

2% (1/1/77)

2% to 3% (1/1/96) Sales

Added exemption on food (3/1/82)

Eliminated the exemption on food (12/31/95)

Added exemption on gas & electricity (1/1/96)

Added service fee (1/1/96)

3% use tax added (1/1/96)

3% to 4% (1/1/2005) Sales only

Self-collected (7/1/08)

4% to 3% (6/1/14)

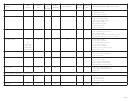

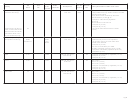

Haxtun

2.5%

Yes

7/1/82

Yes

Y-Z

3 1/3%

1% (7/1/82)

1% to 1.5% (7/1/98)

Use tax increased from 1% to 1.5% (1/1/02)

1.5% to 2.5% Sales only (7/1/10)

Use tax increased from 1.5% to 2.5% (7/1/10)

Hayden

4%

Yes

1/1/73

Yes

Z

3 1/3%

2% to 3% (1/1/84)

Use Tax 2% (1/1/86)

3% to 4% (7/1/88)

Removed use tax on motor vehicles (12/31/07)

Added use tax on building materials (1/1/08)

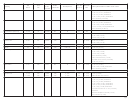

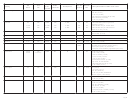

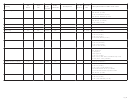

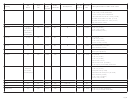

Health Services District

Montezuma County

.4%

Yes

1/1/16

Yes

A-B-C-D-E-G-H-K-L-

Y-Z

3 1/3%

Exemption P (7/1/16)

Hospital District

M-N-O-P-Q

Exemption Q (7/1/17)

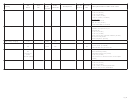

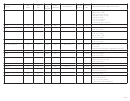

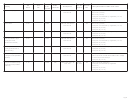

Hinsdale County Sales

5%

Yes

1/1/73

Yes

Y-Z

3 1/3%

First 2% Sales tax point of

collection between county and

Lake City additional 2% Sales

and Use tax (except MV) to be

shared equally between county and

Lake City. Use tax - MV 100% county

2 to 4% (7/1/86) - Use Tax (7/1/86)

4% to 5% sales (1/1/2003) (1% for Lake Forks

Health District)

100% County-IGA removed effective (2/1/06)

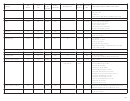

Hinsdale County Lodging

1.9%

1/1/93

Yes

Pg 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40