Form Dr 1250 - History Of Local Sales/use Taxes Page 38

ADVERTISEMENT

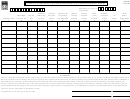

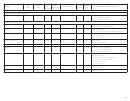

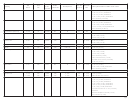

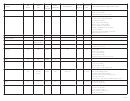

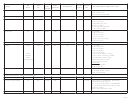

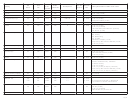

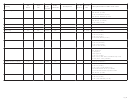

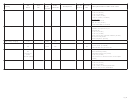

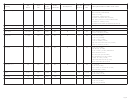

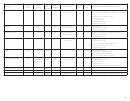

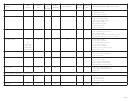

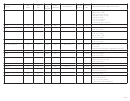

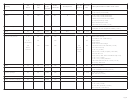

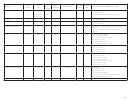

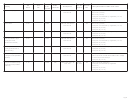

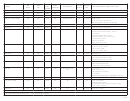

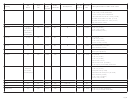

TAX RATE

Summary

Total # 0.01% 0.1% 0.2% 0.25% 0.4% 0.43% 0.5% 0.6% 0.65% 0.725% 0.75% 0.8% 0.9% 0.985% 1.0% 1.23% 1.3% 1.4% 1.5% 1.8% 1.8125% 1.9% 2.0% 2.1% 2.25% 2.3% 2.4% 2.5%

Football District

0

Cities & Towns

230

7

2

1

47

2

2

1

1

10

Counties*

49

1

1

1

1

1

19

1

1

1

11

1

1

Cultural District

1

1

Local Improvement District

8

1

1

1

2

3

Local Marketing District

6

1

2

Mass Transit ****

3

2

1

Metropolitan District

5

1

1

1

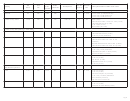

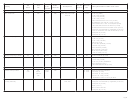

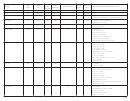

Roaring Fork

Basalt/New Castle

2

2

Carbondale/Glenwood Springs

2

2

Aspen, Snowmass Vlg, Pitkin Rem

3

3

El Jebel, Outside Carbondale

2

2

Pikes Peak RTA

1

1

Gunnison Valley RTA

1

1

Baptist Road RTA

0

San Miguel RTA

1

1

South Platte Valley RTA

1

1

States Sales Tax

1

Retail Marijuana Sales

1

RTD

1

1

County Lodging Tax

28

1

1

17

9

Multi-Juris Housing

1

1

Public Safety Improvement

1

1

Health Services District

1

1

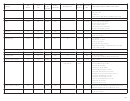

Totals

349

1

2

1

2

4

1

6

2

1

1

3

2

1

1

35

1

1

1

4

1

1 17

69

3

2

1

1

11

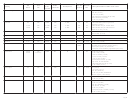

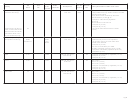

A - Exempts food

I - Exempts telephone & telegraph service

W - Contact city directly

Fork RTA district has 4 different tax rates

B - Exempts machinery and machine tools

J - Exempts gas & electricity for residential &

Y - Use tax on motor vehicles

**** The Mass Transit tax rates are included

(Industrial Use)

commercial use

in the county rates in the DR 1002 and for

Z - Use tax on building materials

reporting purposes. These rates are .5%

C - Exempts gas and electricity, etc.;

K - Renewable energy components (effective

in Eagle and Pitkin Counties and .75% in

*

Pitkin County is counted under both 2.1%

For domestic use

7/1/08, but retroactive to 7/1/06)

.

and 3.1% for the county tax rate summary.

Summit County

D - Occasional sales by charitable

L - Beetle wood products (effective 7/1/08)

*** County lodging tax cannot be charged when

***** Sales tax rate is reduced if purchases are

organizations

M - School related sales (effective 9/1/08)

a city has its own lodging tax.

made from certain areas subject to either a

E - Farm equipment

N - Biogas production system components

Public Improvement Fee (PIF) and/or Retail

The state collects all 51 county levies. The

F - Pesticides - Effective July 1, 2012 sales

O - Property used in space flight

Sales Fee (RSF). Contact the respective

state collects 152 of 222 municipal levies

of pesticides are considered wholesale

home-ruled city for more details.

P - Machine or machine tools equipment

plus Cultural District, County lodging, 6 of 8

sales and are not subject to state or state

used for processing recovered materials

Local Improvement districts, Mass Transit,

collected local sales or use taxes.

per list on Public Health & Environment.

RTD, Local Market, Multi-Juris Housing,

G - Food sold through vending machines

Public Safety Improvement, Metropolitan

Q - Retail Marijuana and marijuana products

H - Low-emitting vehicles

district and 5 RTA Districts. The Roaring

Page 38

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40