Form Nc-478l - Tax Credit - Investing In Real Property - 2014

ADVERTISEMENT

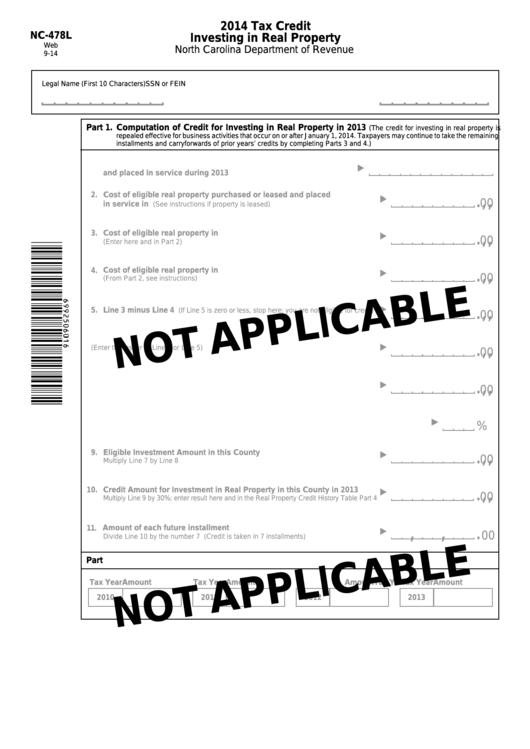

2014 Tax Credit

NC-478L

Investing in Real Property

Web

North Carolina Department of Revenue

9-14

Legal Name (First 10 Characters)

SSN or FEIN

Part 1.

Computation of Credit for Investing in Real Property in 2013

(The credit for investing in real property is

repealed effective for business activities that occur on or after January 1, 2014. Taxpayers may continue to take the remaining

installments and carryforwards of prior years’ credits by completing Parts 3 and 4.)

1. Tier 1 county where eligible real property was purchased or leased

and placed in service during 2013

2.

Cost of eligible real property purchased or leased and placed

,

,

.

00

in service in N.C. during 2013

(See instructions if property is leased)

,

,

.

3. Cost of eligible real property in N.C. on the last day of 2013

00

(Enter here and in Part 2)

,

,

.

4. Cost of eligible real property in N.C. on the last day of the base year

00

(From Part 2, see instructions)

,

,

.

5. Line 3 minus Line 4

(If Line 5 is zero or less, stop here; you are not eligible for credit)

00

,

,

.

6. Eligible Investment Amount Statewide

(Enter the lesser of Line 2 or Line 5)

00

,

,

.

7. Amount of Line 6 located in this county

00

8. Percentage of real property used in eligible business in 2013

%

,

,

.

9. Eligible Investment Amount in this County

00

Multiply Line 7 by Line 8

,

,

.

10. Credit Amount for Investment in Real Property in this County in 2013

00

Multiply Line 9 by 30%; enter result here and in the Real Property Credit History Table Part 4

,

,

.

11. Amount of each future installment

00

Divide Line 10 by the number 7 (Credit is taken in 7 installments)

Part 2. Real Property in Service in N.C. on Last Day of Tax Year

Tax Year

Amount

Tax Year

Amount

Tax Year

Amount

Tax Year

Amount

2010

2011

2012

2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2