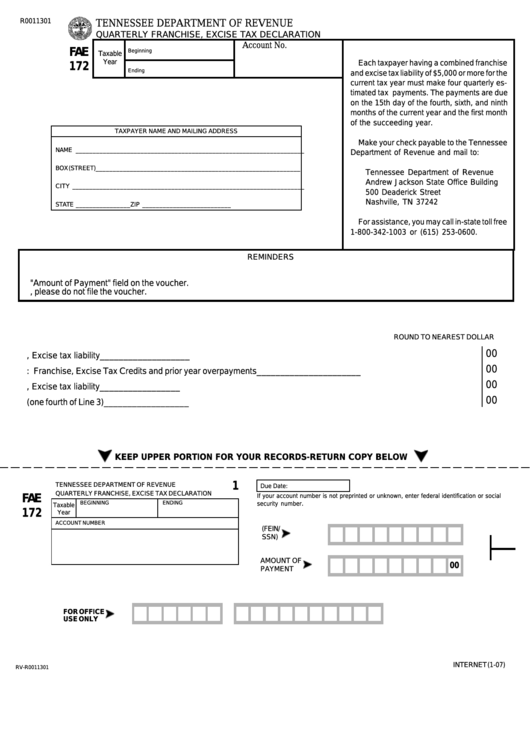

R0011301

TENNESSEE DEPARTMENT OF REVENUE

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION

Account No.

FAE

Beginning

Taxable

Year

Each taxpayer having a combined franchise

172

Ending

and excise tax liability of $5,000 or more for the

current tax year must make four quarterly es-

timated tax payments. The payments are due

on the 15th day of the fourth, sixth, and ninth

months of the current year and the first month

of the succeeding year.

TAXPAYER NAME AND MAILING ADDRESS

Make your check payable to the Tennessee

NAME ___________________________________________________________________

Department of Revenue and mail to:

BOX (STREET) ____________________________________________________________

Tennessee Department of Revenue

Andrew Jackson State Office Building

CITY ____________________________________________________________________

500 Deaderick Street

Nashville, TN 37242

STATE ________________

ZIP __________________________

For assistance, you may call in-state toll free

1-800-342-1003 or (615) 253-0600.

REMINDERS

1. Please read instructions on reverse side before preparing worksheet.

2. Use the prenumbered vouchers and envelopes provided by the Department of Revenue.

3. Enter the amount from Line 4 of the worksheet to the "Amount of Payment" field on the voucher.

4. If Line 4 of the worksheet is zero, please do not file the voucher.

ROUND TO NEAREST DOLLAR

00

1. Estimated Franchise, Excise tax liability .................................................................................

______________________

00

2. Less: Franchise, Excise Tax Credits and prior year overpayments .........................................

______________________

00

3. Net Estimated Franchise, Excise tax liability ...........................................................................

______________________

00

4. Estimated payment (one fourth of Line 3) .................................................................................

______________________

KEEP UPPER PORTION FOR YOUR RECORDS-RETURN COPY BELOW

1

TENNESSEE DEPARTMENT OF REVENUE

Due Date:

QUARTERLY FRANCHISE, EXCISE TAX DECLARATION

FAE

If your account number is not preprinted or unknown, enter federal identification or social

BEGINNING

ENDING

.

security number

Taxable

172

Year

ACCOUNT NUMBER

(FEIN/

SSN)

AMOUNT OF

00

PAYMENT

FOR OFFICE

USE ONLY

INTERNET (1-07)

RV-R0011301

1

1 2

2 3

3