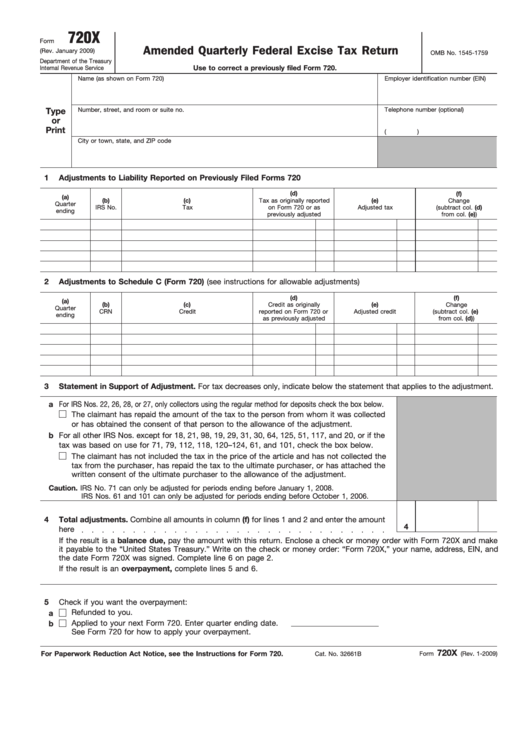

720X

Form

Amended Quarterly Federal Excise Tax Return

(Rev. January 2009)

OMB No. 1545-1759

Department of the Treasury

Use to correct a previously filed Form 720.

Internal Revenue Service

Name (as shown on Form 720)

Employer identification number (EIN)

Number, street, and room or suite no.

Telephone number (optional)

Type

or

Print

(

)

City or town, state, and ZIP code

1

Adjustments to Liability Reported on Previously Filed Forms 720

(d)

(f)

(a)

(b)

(c)

Tax as originally reported

(e)

Change

Quarter

IRS No.

Tax

on Form 720 or as

Adjusted tax

(subtract col. (d)

ending

previously adjusted

from col. (e))

2

Adjustments to Schedule C (Form 720) (see instructions for allowable adjustments)

(d)

(f)

(a)

(b)

(c)

Credit as originally

(e)

Change

Quarter

CRN

Credit

reported on Form 720 or

Adjusted credit

(subtract col. (e)

ending

as previously adjusted

from col. (d))

3

Statement in Support of Adjustment. For tax decreases only, indicate below the statement that applies to the adjustment.

a For IRS Nos. 22, 26, 28, or 27, only collectors using the regular method for deposits check the box below.

The claimant has repaid the amount of the tax to the person from whom it was collected

or has obtained the consent of that person to the allowance of the adjustment.

b

For all other IRS Nos. except for 18, 21, 98, 19, 29, 31, 30, 64, 125, 51, 117, and 20, or if the

tax was based on use for 71, 79, 112, 118, 120–124, 61, and 101, check the box below.

The claimant has not included the tax in the price of the article and has not collected the

tax from the purchaser, has repaid the tax to the ultimate purchaser, or has attached the

written consent of the ultimate purchaser to the allowance of the adjustment.

Caution. IRS No. 71 can only be adjusted for periods ending before January 1, 2008.

IRS Nos. 61 and 101 can only be adjusted for periods ending before October 1, 2006.

4

Total adjustments. Combine all amounts in column (f) for lines 1 and 2 and enter the amount

4

here

If the result is a balance due, pay the amount with this return. Enclose a check or money order with Form 720X and make

it payable to the “United States Treasury.” Write on the check or money order: “Form 720X,” your name, address, EIN, and

the date Form 720X was signed. Complete line 6 on page 2.

If the result is an overpayment, complete lines 5 and 6.

5

Check if you want the overpayment:

Refunded to you.

a

Applied to your next Form 720. Enter quarter ending date.

b

See Form 720 for how to apply your overpayment.

720X

For Paperwork Reduction Act Notice, see the Instructions for Form 720.

Cat. No. 32661B

Form

(Rev. 1-2009)

1

1 2

2 3

3