Instructions For Form 720x - Amended Quarterly Federal Excise Tax Return

ADVERTISEMENT

2

Form 720X (1-2002)

Page

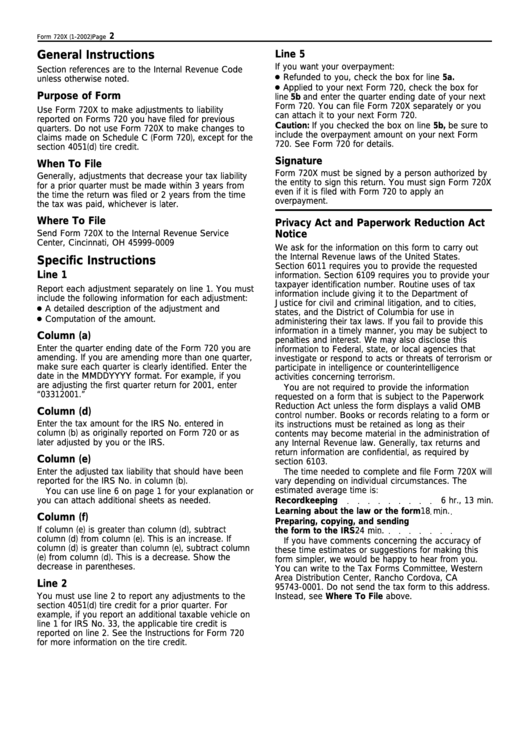

General Instructions

Line 5

If you want your overpayment:

Section references are to the Internal Revenue Code

● Refunded to you, check the box for line 5a.

unless otherwise noted.

● Applied to your next Form 720, check the box for

Purpose of Form

line 5b and enter the quarter ending date of your next

Form 720. You can file Form 720X separately or you

Use Form 720X to make adjustments to liability

can attach it to your next Form 720.

reported on Forms 720 you have filed for previous

Caution: If you checked the box on line 5b, be sure to

quarters. Do not use Form 720X to make changes to

include the overpayment amount on your next Form

claims made on Schedule C (Form 720), except for the

720. See Form 720 for details.

section 4051(d) tire credit.

Signature

When To File

Form 720X must be signed by a person authorized by

Generally, adjustments that decrease your tax liability

the entity to sign this return. You must sign Form 720X

for a prior quarter must be made within 3 years from

even if it is filed with Form 720 to apply an

the time the return was filed or 2 years from the time

overpayment.

the tax was paid, whichever is later.

Where To File

Privacy Act and Paperwork Reduction Act

Send Form 720X to the Internal Revenue Service

Notice

Center, Cincinnati, OH 45999-0009

We ask for the information on this form to carry out

the Internal Revenue laws of the United States.

Specific Instructions

Section 6011 requires you to provide the requested

Line 1

information. Section 6109 requires you to provide your

taxpayer identification number. Routine uses of tax

Report each adjustment separately on line 1. You must

information include giving it to the Department of

include the following information for each adjustment:

Justice for civil and criminal litigation, and to cities,

● A detailed description of the adjustment and

states, and the District of Columbia for use in

● Computation of the amount.

administering their tax laws. If you fail to provide this

information in a timely manner, you may be subject to

Column (a)

penalties and interest. We may also disclose this

Enter the quarter ending date of the Form 720 you are

information to Federal, state, or local agencies that

amending. If you are amending more than one quarter,

investigate or respond to acts or threats of terrorism or

make sure each quarter is clearly identified. Enter the

participate in intelligence or counterintelligence

date in the MMDDYYYY format. For example, if you

activities concerning terrorism.

are adjusting the first quarter return for 2001, enter

You are not required to provide the information

“03312001.”

requested on a form that is subject to the Paperwork

Reduction Act unless the form displays a valid OMB

Column (d)

control number. Books or records relating to a form or

Enter the tax amount for the IRS No. entered in

its instructions must be retained as long as their

column (b) as originally reported on Form 720 or as

contents may become material in the administration of

later adjusted by you or the IRS.

any Internal Revenue law. Generally, tax returns and

return information are confidential, as required by

Column (e)

section 6103.

Enter the adjusted tax liability that should have been

The time needed to complete and file Form 720X will

reported for the IRS No. in column (b).

vary depending on individual circumstances. The

estimated average time is:

You can use line 6 on page 1 for your explanation or

you can attach additional sheets as needed.

Recordkeeping

6 hr., 13 min.

Learning about the law or the form

18 min.

Column (f)

Preparing, copying, and sending

If column (e) is greater than column (d), subtract

the form to the IRS

24 min.

column (d) from column (e). This is an increase. If

If you have comments concerning the accuracy of

column (d) is greater than column (e), subtract column

these time estimates or suggestions for making this

(e) from column (d). This is a decrease. Show the

form simpler, we would be happy to hear from you.

decrease in parentheses.

You can write to the Tax Forms Committee, Western

Area Distribution Center, Rancho Cordova, CA

Line 2

95743-0001. Do not send the tax form to this address.

You must use line 2 to report any adjustments to the

Instead, see Where To File above.

section 4051(d) tire credit for a prior quarter. For

example, if you report an additional taxable vehicle on

line 1 for IRS No. 33, the applicable tire credit is

reported on line 2. See the Instructions for Form 720

for more information on the tire credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1