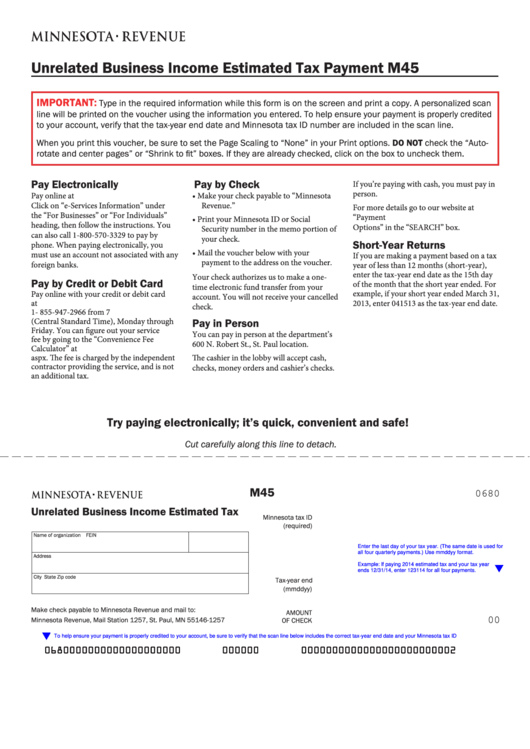

Unrelated Business Income Estimated Tax Payment

M45

IMPORTANT:

Type in the required information while this form is on the screen and print a copy. A personalized scan

line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited

to your account, verify that the tax-year end date and Minnesota tax ID number are included in the scan line.

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto-

rotate and center pages” or “Shrink to fit” boxes. If they are already checked, click on the box to uncheck them.

Pay Electronically

Pay by Check

If you’re paying with cash, you must pay in

person.

Pay online at

• Make your check payable to “Minnesota

Click on “e-Services Information” under

Revenue. ”

For more details go to our website at www.

the “For Businesses” or “For Individuals”

revenue.state.mn.us and type “Payment

• Print your Minnesota ID or Social

heading, then follow the instructions. You

Options” in the “SEARCH” box.

Security number in the memo portion of

can also call 1-800-570-3329 to pay by

your check.

Short-Year Returns

phone. When paying electronically, you

• Mail the voucher below with your

must use an account not associated with any

If you are making a payment based on a tax

payment to the address on the voucher.

foreign banks.

year of less than 12 months (short-year),

enter the tax-year end date as the 15th day

Your check authorizes us to make a one-

Pay by Credit or Debit Card

of the month that the short year ended. For

time electronic fund transfer from your

example, if your short year ended March 31,

Pay online with your credit or debit card

account. You will not receive your cancelled

at You can also call

2013, enter 041513 as the tax-year end date.

check.

1- 855-947-2966 from 7 a.m. to 7 p.m.

(Central Standard Time), Monday through

Pay in Person

Friday. You can figure out your service

You can pay in person at the department’s

fee by going to the “Convenience Fee

600 N. Robert St., St. Paul location.

Calculator” at

aspx. The fee is charged by the independent

The cashier in the lobby will accept cash,

contractor providing the service, and is not

checks, money orders and cashier’s checks.

an additional tax.

Try paying electronically; it’s quick, convenient and safe!

Cut carefully along this line to detach.

M45

0680

Unrelated Business Income Estimated Tax

Minnesota tax ID

(required)

Name of organization

FEIN

Enter the last day of your tax year. (The same date is used for

all four quarterly payments.) Use mmddyy format.

Address

Example: If paying 2014 estimated tax and your tax year

ends 12/31/14, enter 123114 for all four payments.

City

State

Zip code

Tax-year end

(mmddyy)

Make check payable to Minnesota Revenue and mail to:

AMOUNT

Minnesota Revenue, Mail Station 1257, St. Paul, MN 55146-1257

OF CHECK

00

To help ensure your payment is properly credited to your account, be sure to verify that the scan line below includes the correct tax-year end date and your Minnesota tax ID.

0680000000000000000000123110000000

000000

0000000000000000000000002

1

1