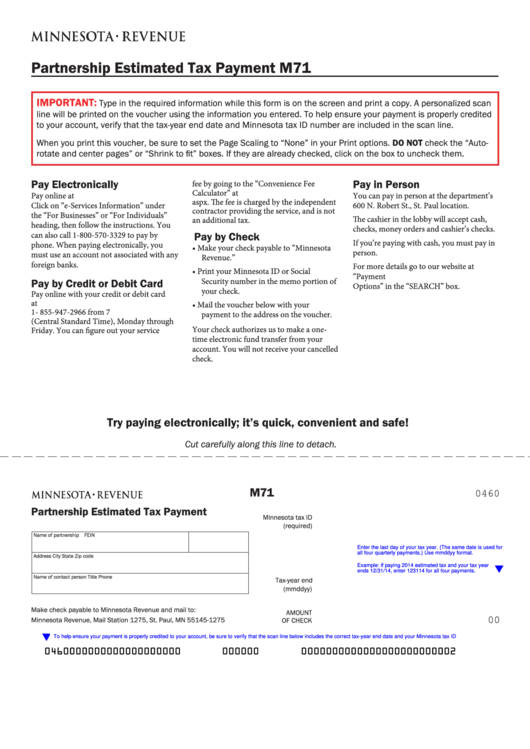

Partnership Estimated Tax Payment

M71

IMPORTANT:

Type in the required information while this form is on the screen and print a copy. A personalized scan

line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited

to your account, verify that the tax-year end date and Minnesota tax ID number are included in the scan line.

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto-

rotate and center pages” or “Shrink to fit” boxes. If they are already checked, click on the box to uncheck them.

Pay Electronically

Pay in Person

fee by going to the “Convenience Fee

Calculator” at

Pay online at

You can pay in person at the department’s

aspx. The fee is charged by the independent

Click on “e-Services Information” under

600 N. Robert St., St. Paul location.

contractor providing the service, and is not

the “For Businesses” or “For Individuals”

The cashier in the lobby will accept cash,

an additional tax.

heading, then follow the instructions. You

checks, money orders and cashier’s checks.

can also call 1-800-570-3329 to pay by

Pay by Check

If you’re paying with cash, you must pay in

phone. When paying electronically, you

• Make your check payable to “Minnesota

person.

must use an account not associated with any

Revenue. ”

foreign banks.

For more details go to our website at www.

• Print your Minnesota ID or Social

revenue.state.mn.us and type “Payment

Security number in the memo portion of

Pay by Credit or Debit Card

Options” in the “SEARCH” box.

your check.

Pay online with your credit or debit card

at You can also call

• Mail the voucher below with your

1- 855-947-2966 from 7 a.m. to 7 p.m.

payment to the address on the voucher.

(Central Standard Time), Monday through

Your check authorizes us to make a one-

Friday. You can figure out your service

time electronic fund transfer from your

account. You will not receive your cancelled

check.

Try paying electronically; it’s quick, convenient and safe!

Cut carefully along this line to detach.

M71

0460

Partnership Estimated Tax Payment

Minnesota tax ID

(required)

Name of partnership

FEIN

Enter the last day of your tax year. (The same date is used for

all four quarterly payments.) Use mmddyy format.

Address

City

State

Zip code

Example: If paying 2014 estimated tax and your tax year

ends 12/31/14, enter 123114 for all four payments.

Name of contact person

Title

Phone

Tax-year end

(mmddyy)

Make check payable to Minnesota Revenue and mail to:

AMOUNT

Minnesota Revenue, Mail Station 1275, St. Paul, MN 55145-1275

OF CHECK

00

t

To help ensure your payment is properly credited to your account, be sure to verify that the scan line below includes the correct tax-year end date and your Minnesota tax ID.

0460000000000000000000123110000000

000000

0000000000000000000000002

1

1