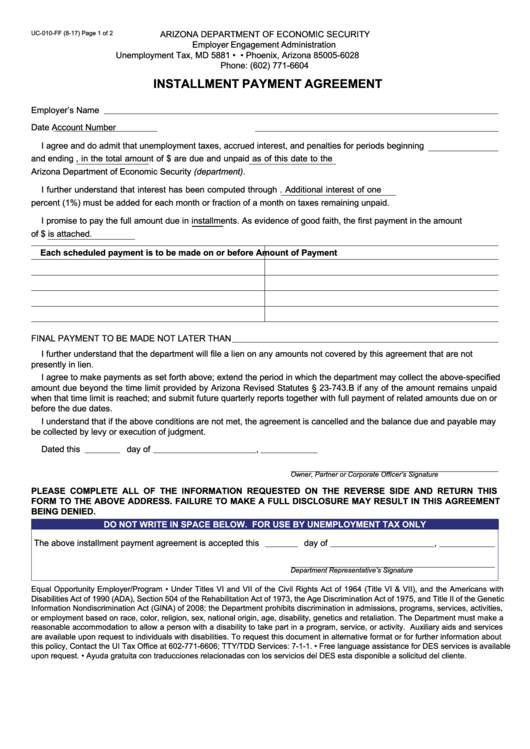

ARIZONA DEPARTMENT OF ECONOMIC SECURITY

UC-010-FF (8-17)

Page 1 of 2

Employer Engagement Administration

Unemployment Tax, MD 5881 • P.O. Box 6028 • Phoenix, Arizona 85005-6028

Phone: (602) 771-6604

INSTALLMENT PAYMENT AGREEMENT

Employer’s Name

Date

Account Number

I agree and do admit that unemployment taxes, accrued interest, and penalties for periods beginning

and ending

, in the total amount of $

are due and unpaid as of this date to the

Arizona Department of Economic Security (department).

I further understand that interest has been computed through

. Additional interest of one

percent (1%) must be added for each month or fraction of a month on taxes remaining unpaid.

I promise to pay the full amount due in

installments. As evidence of good faith, the first payment in the amount

of $

is attached.

Each scheduled payment is to be made on or before

Amount of Payment

FINAL PAYMENT TO BE MADE NOT LATER THAN

I further understand that the department will file a lien on any amounts not covered by this agreement that are not

presently in lien.

I agree to make payments as set forth above; extend the period in which the department may collect the above-specified

amount due beyond the time limit provided by Arizona Revised Statutes § 23-743.B if any of the amount remains unpaid

when that time limit is reached; and submit future quarterly reports together with full payment of related amounts due on or

before the due dates.

I understand that if the above conditions are not met, the agreement is cancelled and the balance due and payable may

be collected by levy or execution of judgment.

Dated this

day of

,

Owner, Partner or Corporate Officer’s Signature

PLEASE COMPLETE ALL OF THE INFORMATION REQUESTED ON THE REVERSE SIDE AND RETURN THIS

FORM TO THE ABOVE ADDRESS. FAILURE TO MAKE A FULL DISCLOSURE MAY RESULT IN THIS AGREEMENT

BEING DENIED.

DO NOT WRITE IN SPACE BELOW. FOR USE BY UNEMPLOYMENT TAX ONLY

The above installment payment agreement is accepted this

day of

,

Department Representative’s Signature

Equal Opportunity Employer/Program • Under Titles VI and VII of the Civil Rights Act of 1964 (Title VI & VII), and the Americans with

Disabilities Act of 1990 (ADA), Section 504 of the Rehabilitation Act of 1973, the Age Discrimination Act of 1975, and Title II of the Genetic

Information Nondiscrimination Act (GINA) of 2008; the Department prohibits discrimination in admissions, programs, services, activities,

or employment based on race, color, religion, sex, national origin, age, disability, genetics and retaliation. The Department must make a

reasonable accommodation to allow a person with a disability to take part in a program, service, or activity. Auxiliary aids and services

are available upon request to individuals with disabilities. To request this document in alternative format or for further information about

this policy, Contact the UI Tax Office at 602-771-6606; TTY/TDD Services: 7-1-1. • Free language assistance for DES services is available

upon request. • Ayuda gratuita con traducciones relacionadas con los servicios del DES esta disponible a solicitud del cliente.

1

1 2

2