INSTRUCTIONS

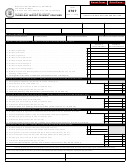

Transferable Credit Payment Voucher

General Information

The Louisiana Department of Revenue has limited authority to apply a purchased income or corporation franchise tax credit to an out-

standing balance.

1.

If you purchased a credit, the credit is property and can be used to pay any outstanding tax liability for the tax against which the

credit was originally granted and any related penalty and interest.

2.

This voucher can only be used to pay on one tax period. If you have more than one tax period that you want to apply the credit to,

you must complete a separate voucher for each period. You may use one voucher to pay an outstanding liability with more than one

purchased credit.

3.

You must attach transfer documents for each credit utilized if the credit was issued prior to January 1, 2014. A copy of your Credit

Registration Form, R-6135, must be attached if the credit was issued on or after January 1, 2014.

Taxpayers that cannot use this form:

1.

The taxpayer who initially earned the credit.

2.

Taxpayers who earned the credit or received the credit by flow through. In this instance, the credit will be treated as a tax item and

can only be applied against tax.

Specific Instructions

1.

Check the appropriate if you are an individual or a business.

2.

Telephone – self-explanatory.

3.

Name of Taxpayer/Entity and Name of Taxpayer’s Spouse. Identify the taxpayer who acquired the credit through a purchase. If

taxpayer is an entity, enter the legal corporation name. If the taxpayer is an individual, enter the individual’s name. You must enter

the spouse name and social security number if the outstanding balance is for a return filed jointly or the credit was acquired jointly.

4.

Social Security No./Entity Louisiana revenue account number – self-explanatory.

5.

Address – self-explanatory.

6.

City, State, ZIP Code – self-explanatory.

7.

Select tax credit and enter available credit amount – Mark the box next to the tax credit that you purchased and wish to use as

payment against an outstanding tax liability. You may select more than one credit. In the space next to the selected credit, enter the

amount of credit being used as a payment.

8.

Tax Type with Outstanding Balance – Mark the box next to the tax type that has the outstanding balance. Select only one tax type.

9.

Tax Period with Outstanding Balance – Enter the tax period has the outstanding balance. This voucher can only be used to pay on

one tax period. If you have more than one tax period that you want to apply the credit to, you must complete a separate voucher for

each period.

10. Amount of Credit to be applied to Outstanding Balance – Enter the total amount of credits to be applied to the above referenced tax

and period.

Please sign and date your payment request.

Questions concerning this matter can be directed to the Office Audit Division at (225) 219-2270 or TaxCredit.Registry@La.gov.

1

1 2

2