2

Form 8330 (Rev. 10-2012)

Page

General Instructions

not include all the MCCs issued on a timely filed

Line 8. Include the total amount of MCCs issued for

return is subject to a penalty. The penalty is $200 for

all prior quarters under the MCC program elected for

each MCC required to be reported on Form 8330.

the nonissued bond amount shown in Part I, whether

Section references are to the Internal Revenue Code

The maximum penalty is $2,000.

or not issued during the current calendar year.

unless otherwise noted.

Line 9. Enter the aggregate, as of the end of the

Section 25 permits issuers that have authority to

Definitions

quarter, of amounts for all certificates issued for the

issue qualified mortgage bonds (as defined in

section 143) to elect to issue MCCs in lieu of

Mortgage credit certificate. A mortgage credit

MCC program elected for the nonissued bond

amount shown in Part I.

qualified mortgage bonds. See Temporary

certificate is a certificate issued under a “qualified

Regulations section 1.25-4T(c)(2) for more details.

mortgage credit certificate program” by the state or

Line 10. If the amount on line 9 exceeds 25% of the

political subdivision having the authority to issue

nonissued bond amount shown in Part I, see section

Future Developments

qualified mortgage bonds to provide financing for

25(f) and Temporary Regulations section 1.25-5T(d)

the acquisition, qualified rehabilitation, or qualified

for the appropriate calculation to reduce the

For the latest information about developments

home improvement of a taxpayer’s principal

following year’s bond volume cap under section

related to Form 8330 and its instructions, such as

residence. For more information, see section 25(c)(1).

146(d).

legislation enacted after they were published, go to

Qualified mortgage credit certificate program. A

Part III. Revocation of Qualified

qualified mortgage credit certificate program is a

Purpose of Form

Mortgage Credit Certificates

program established for any calendar year by a

state or political subdivision that is authorized to

Form 8330 is used by issuers (states and political

Identify each holder of a qualified MCC that was

issue qualified mortgage bonds under section 143

subdivisions) of MCCs to provide the IRS with

revoked during the calendar quarter. For more

(and for which there has been an appropriate

information required by section 25 and Temporary

information, see Temporary Regulations section

allocation of state volume cap for that calendar year

Regulations section 1.25-8T(b).

1.25-3T(m).

under section 146), but elected instead to issue

mortgage credit certificates. (See section 25(c)(2) for

Who Must File

Signature

additional requirements.)

Each issuer that elected to issue MCCs must file

Aggregate amount. The aggregate amount (the

Form 8330 must be signed by an authorized

Form 8330 for each qualified mortgage credit

certified indebtedness times the certificate credit

representative of the issuer.

certificate program.

rate for each MCC, totaled for all mortgage credit

Paid Preparer Use Only

certificates issued under a single MCC program),

When To File

may not exceed 25% of the nonissued bond amount

Anyone who prepares the return but does not

for which the election not to issue bonds was made.

File Form 8330 on a quarterly basis beginning with

charge the organization should not sign the return.

the quarter in which the election was made.

See section 25(d)(2).

Certain others who prepare the return should not

Certified indebtedness amount. The certified

The return for each MCC program is due as

sign. For example, a regular, full-time employee of

follows:

indebtedness amount is the amount of indebtedness

the issuer, such as a clerk, secretary, etc., should

specified in the MCC and incurred by a taxpayer:

not sign.

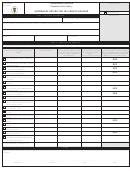

For the quarter

Form 8330

a. To acquire his or her principal residence,

ending:

is due by:

Generally, anyone who is paid to prepare a return

must sign it and fill in the other blanks in the Paid

March 31 .

.

.

.

.

.

.

.

.

April 30

b. To make qualified home improvements on that

Preparer Use Only area of the return. A paid preparer

residence, or

June 30

.

.

.

.

.

.

.

.

.

July 31

cannot use a social security number in the paid Paid

c. To make a qualified rehabilitation of that

Preparer Use Only box. The paid preparer must use

September 30 .

.

.

.

.

.

.

October 31

residence.

a preparer tax identification number (PTIN). If the

December 31 .

.

.

.

.

.

.

January 31

paid preparer is self-employed, the preparer should

Certificate credit rate. The certificate credit rate is

The IRS may grant an extension of time to file

enter his or her address in the box. The paid

the rate specified by the issuer on the MCC.

Form 8330 if there is reasonable cause for not filing

preparer must:

However, the rate cannot be less than 10% nor

on time.

more than 50%. For other limitations, see

• Sign the return in the space provided for the

Temporary Regulations section 1.25-2T(b).

Last Form 8330 for a program. In the quarter in

preparer’s signature,

which the last qualified MCC that may be issued

Specific Instructions

• Enter the preparer information, and

under a program is in fact issued, the issuer should

• Give a copy of the return to the issuer.

check the box marked “Yes” in Part I relating to a

Part I. Reporting Authority

final return for this MCC program. Thereafter, the

Paperwork Reduction Act Notice. We ask for the

issuer is not required to file any subsequent reports

information on this form to carry out the Internal

Election date. Enter the date the issuer elected to

with respect to that MCC program. See Qualified

Revenue laws of the United States. You are required

issue MCCs in lieu of qualified mortgage bonds.

mortgage credit certificate program in the definitions

to give us the information. We need it to ensure that

below.

Nonissued bond amount. Enter the total amount of

you are complying with these laws.

qualified mortgage bonds (as defined in section

Reissued MCCs. Do not report a reissued MCC on

You are not required to provide the information

143(a)(1), and the related regulations) that the issuer

Form 8330. A reissued MCC is considered to be a

requested on a form that is subject to the Paperwork

has authority to issue but elected instead to convert

continuation of the original MCC. It is reported by

Reduction Act unless the form displays a valid OMB

into authority to issue MCCs. The amount of

the lender of the replacement loan on Form 8329,

control number. Books or records relating to a form

qualified mortgage bonds that an issuer elected not

Lender’s Information Return for Mortgage Credit

or its instructions must be retained as long as their

to issue may not exceed the issuer’s applicable limit

Certificates (MCCs).

contents may become material in the administration

(as determined under section 146(d)).

Aggregate number of Forms 8330 filed per

of any Internal Revenue law. Generally, tax returns

Part II. Computation of the Total

program. Certificates under an MCC program may

and return information are confidential, as required

be issued for indebtedness that is incurred up to the

by section 6103.

Amount of Mortgage Credit

close of the 2nd calendar year following the calendar

The time needed to complete and file this form

Certificates

year for which the issuing authority made the

will vary depending on individual circumstances.

election to issue MCCs in lieu of qualified mortgage

The estimated average time is:

List only the MCCs issued under the program

bonds. Thus, there may be as many as 12

elected for the nonissued bond amount shown in

Recordkeeping .

.

.

.

.

. 4 hr., 32 min.

consecutive quarterly reports to be filed by the

Part I. File a separate Form 8330 for each separate

issuer for a particular MCC program. See section

Learning about the law

program that is still open.

25(e)(3)(B).

or the form

.

.

.

.

.

.

. 1 hr., 23 min.

Column (a). Enter the certified indebtedness

Multiple Forms 8330 filed for a quarter. More than

Preparing and sending

amount for each MCC issued under the qualified

one Form 8330 may be filed for a particular quarter

the form to the IRS .

.

.

.

. 1 hr., 31 min.

MCC program.

for an issuer if the issuer had more than one MCC

If you have comments concerning the accuracy of

Column (b). Enter the certificate credit rate

program in operation during a calendar quarter. This

these time estimates or suggestions for making this

may occur where more than one election was made

associated with each MCC entered in column (a).

form simpler, we would be happy to hear from you.

during a calendar year, or where certificates still

Column (c). For each certificate amount listed in

You can write to the Internal Revenue Service, Tax

remain to be issued under one MCC program, after

column (a), multiply by the certificate credit rate

Products Coordinating Committee,

an election has been made creating another

associated with that certificate (column (b)) and

SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW,

program.

enter the result in column (c).

IR-6526, Washington, DC 20224. Do not send the

Where To File

tax form to this address. Instead, see Where To File

If additional space is needed, attach a separate

on this page.

statement in the same format as lines 1 through 6 of

File Form 8330 with the Department of the Treasury,

Part II of this Form 8330. Include the total amount of

Internal Revenue Service Center, Ogden, UT 84201.

the MCCs listed on the separate statements only on

line 7 of the Form 8330. You may use an unsigned

Penalty

copy of a Form 8330 as the separate statement.

Any person who is required to file Form 8330 and

who does not file that return by the due date or does

1

1 2

2