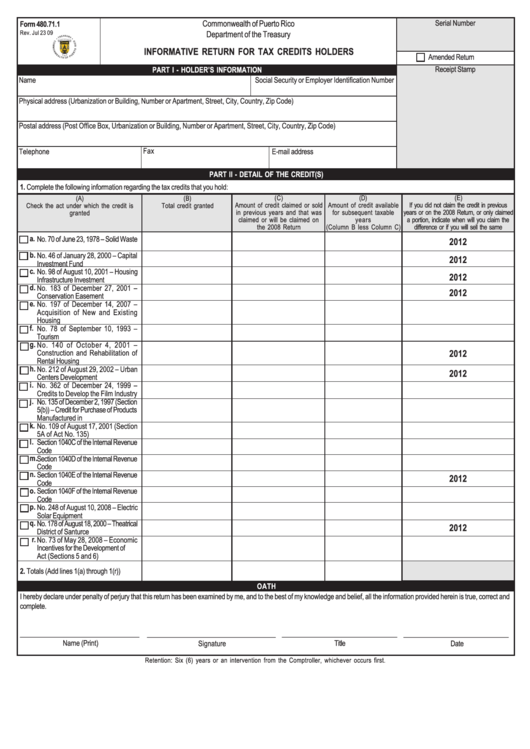

Form 480.71.1 - Informative Return For Tax Credits Holders

ADVERTISEMENT

Serial Number

Commonwealth of Puerto Rico

Form 480.71.1

Rev. Jul 23 09

Department of the Treasury

INFORMATIVE RETURN FOR TAX CREDITS HOLDERS

Amended Return

Receipt Stamp

PART I - HOLDER’S INFORMATION

Name

Social Security or Employer Identification Number

Physical address (Urbanization or Building, Number or Apartment, Street, City, Country, Zip Code)

Postal address (Post Office Box, Urbanization or Building, Number or Apartment, Street, City, Country, Zip Code)

Fax

Telephone

E-mail address

PART II - DETAIL OF THE CREDIT(S)

1. Complete the following information regarding the tax credits that you hold:

(C)

(D)

(E)

(A)

(B)

Amount of credit claimed or sold

Amount of credit available

If you did not claim the credit in previous

Check the act under which the credit is

Total credit granted

years or on the 2008 Return, or only claimed

granted

in previous years and that was

for subsequent taxable

claimed or will be claimed on

years

a portion, indicate when will you claim the

the 2008 Return

(Column B less Column C)

difference or if you will sell the same

a.

No. 70 of June 23, 1978 – Solid Waste

2012

b.

No. 46 of January 28, 2000 – Capital

2012

Investment Fund

c.

No. 98 of August 10, 2001 – Housing

2012

Infrastructure Investment

d.

No. 183 of December 27, 2001 –

2012

Conservation Easement

e.

No. 197 of December 14, 2007 –

Acquisition of New and Existing

Housing

f.

No. 78 of September 10, 1993 –

Tourism

g.

No. 140 of October 4, 2001 –

2012

Construction and Rehabilitation of

Rental Housing

h.

No. 212 of August 29, 2002 – Urban

2012

Centers Development

i.

No. 362 of December 24, 1999 –

Credits to Develop the Film Industry

j.

No. 135 of December 2, 1997 (Section

5(b)) – Credit for Purchase of Products

Manufactured in P.R.

k.

No. 109 of August 17, 2001 (Section

5A of Act No. 135)

l.

Section 1040C of the Internal Revenue

Code

m.

Section 1040D of the Internal Revenue

Code

n.

Section 1040E of the Internal Revenue

2012

Code

o.

Section 1040F of the Internal Revenue

Code

p.

No. 248 of August 10, 2008 – Electric

Solar Equipment

q.

No. 178 of August 18, 2000 – Theatrical

2012

District of Santurce

r.

No. 73 of May 28, 2008 – Economic

Incentives for the Development of P.R.

Act (Sections 5 and 6)

2. Totals (Add lines 1(a) through 1(r))

OATH

I hereby declare under penalty of perjury that this return has been examined by me, and to the best of my knowledge and belief, all the information provided herein is true, correct and

complete.

_______________________________________

__________________________________________

_________________________________________

________________________________

Name (Print)

Signature

Title

Date

Retention: Six (6) years or an intervention from the Comptroller, whichever occurs first.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1