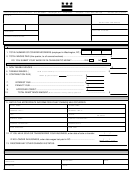

Since your last quarterly report, was there a change in the number of persons who are claimed as depen-

YES

NO

7

dents for federal income tax purposes by you or your spouse? If YES, complete below.

DOES PERSON LIVE

DATE OF

NAME OF PERSON(S)

EXPLAIN WHAT CHANGED

WITH SPONSOR?

CHANGE

YES

NO

YES

NO

Since your last quarterly report, was there any change in payments made to persons who are claimed as

YES

NO

8

federal tax dependents who are not living with you or your spouse? If YES, explain what changed, list the

name of the person(s), amount paid and who paid:

During the report month, did you or your spouse pay any court-ordered support?

YES

NO

9

If YES, enter the amount paid and attach receipts: $

Do you or your spouse have any other information to report such as: a new address, a change in the

YES

NO

10

number of noncitizens that you sponsor and who will receive Cash Aid, recent or anticipated changes in

income, etc.?

If YES, explain the change and if it is expected to be temporary or permanent, and give the date of change.

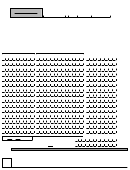

CERTIFICATION SECTION

•

I understand that the term for Sponsorship is normally an indefinite period of time.

•

I understand that failure to report information or misrepresentation of facts for Cash Aid can result in legal prosecution with penalties

of a fine, imprisonment or both.

•

I understand that I may be required to repay any benefits which are overpaid because of incorrectly or incompletely reported

information.

SPONSOR’S CERTIFICATION

•

I declare under penalty of perjury under the laws of the State of California that the information contained in this report is true and

correct and is complete.

SIGNATURE OF SPONSOR

DATE

SIGNATURE OF SPONSOR’S SPOUSE (IF LIVING TOGETHER OR SIGNED AN AFFIDAVIT OF SUPPORT)

DATE

SIGNATURE OF WITNESS TO MARK, INTERPRETER, OR OTHER PERSON COMPLETING FORM

DATE

NONCITIZEN’S CERTIFICATION

•

I have reviewed this signed and completed report from my sponsor(s). I declare under penalty of perjury under the laws of the State

of California that, to the best of my knowledge, the information contained in this report is true and correct and is complete.

NONCITIZEN’S OR DECLARANT’S SIGNATURE OR MARK

DATE

SIGNATURE OF WITNESS TO MARK, INTERPRETER, OR OTHER PERSON COMPLETING FORM

DATE

COUNTY USE ONLY

Evaluation of Sponsor/Sponsor’s Spouse

CalWORKs

Food Stamps Sponsor/Sponsor’s Spouse

Real/Personal Property Resources

Sponsor/Sponsor’s Spouse Income Computation

Income Computation

A.

Earned Income

$ ____________

A.

ITEMS

VALUE

______________

$_______________

A.

Earned Income

$ __________

B.

Less 20%

- ____________

______________

$_______________

B.

Unearned Income

+ __________

C.

Unearned Income

+ ____________

______________

$_______________

D.

Gross Income Deduction

______________

$_______________

C.

Subtotal

= __________

for sponsor’s household

______________

$_______________

D.

Total number of sponsored

size

- ____________

noncitizens applying for/receiving

B.

Total

$ _______________

E.

Subtotal

= ____________

CalWORKs

__________

CW

FS

C.

Less: Food Stamp

F.

Total number of sponsored

NA

$1500

Deduction ($1500)

- _____________

E.

Divide C by D

= __________

noncitizens applying

D.

Subtotal

= _______________

for/receiving Food

F.

Number of sponsored noncitizens

E.

Total number of sponsored

in this AU

__________

Stamps

____________

noncitizens applying

G.

Total (Divide E by F)

= ____________

for/receiving CW/FS

_______________

G.

Total (Multiply E by F)

= __________

F.

Total (Divide D by E) = _______________

Amount in G to be deemed income for each

Amount in F to be included in each noncitizen’s

Amount in G to be deemed income for entire AU.

sponsored noncitizen.

property limits.

PAGE 2 OF 2

QR 72 (12/06) REQUIRED FORM - SUBSTITUTE PERMITTED

1

1 2

2