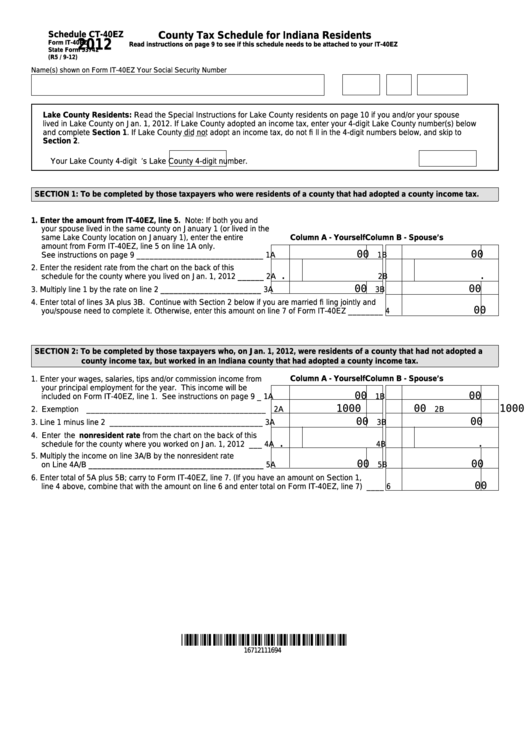

Schedule CT-40EZ

County Tax Schedule for Indiana Residents

2012

Form IT-40EZ

Read instructions on page 9 to see if this schedule needs to be attached to your IT-40EZ

State Form 53742

(R5 / 9-12)

Name(s) shown on Form IT-40EZ

Your Social Security Number

Lake County Residents: Read the Special Instructions for Lake County residents on page 10 if you and/or your spouse

lived in Lake County on Jan. 1, 2012. If Lake County adopted an income tax, enter your 4-digit Lake County number(s) below

and complete Section 1. If Lake County did not adopt an income tax, do not fi ll in the 4-digit numbers below, and skip to

Section 2.

Your Lake County 4-digit number.

Spouse’s Lake County 4-digit number.

SECTION 1: To be completed by those taxpayers who were residents of a county that had adopted a county income tax.

1. Enter the amount from IT-40EZ, line 5. Note: If both you and

your spouse lived in the same county on January 1 (or lived in the

same Lake County location on January 1), enter the entire

Column A - Yourself

Column B - Spouse’s

amount from Form IT-40EZ, line 5 on line 1A only.

00

00

See instructions on page 9 _____________________________

1A

1B

2. Enter the resident rate from the chart on the back of this

.

.

schedule for the county where you lived on Jan. 1, 2012 ______

2A

2B

00

00

3. Multiply line 1 by the rate on line 2 _______________________

3A

3B

4. Enter total of lines 3A plus 3B. Continue with Section 2 below if you are married fi ling jointly and

00

you/spouse need to complete it. Otherwise, enter this amount on line 7 of Form IT-40EZ ________

4

SECTION 2: To be completed by those taxpayers who, on Jan. 1, 2012, were residents of a county that had not adopted a

county income tax, but worked in an Indiana county that had adopted a county income tax.

Column A - Yourself

Column B - Spouse’s

1. Enter your wages, salaries, tips and/or commission income from

your principal employment for the year. This income will be

00

00

included on Form IT-40EZ, line 1. See instructions on page 9 _

1A

1B

1000 00

1000 00

2. Exemption _________________________________________

2A

2B

00

00

3. Line 1 minus line 2 ___________________________________

3A

3B

4. Enter the nonresident rate from the chart on the back of this

.

.

schedule for the county where you worked on Jan. 1, 2012 ___

4A

4B

5. Multiply the income on line 3A/B by the nonresident rate

00

00

on Line 4A/B ________________________________________

5A

5B

6. Enter total of 5A plus 5B; carry to Form IT-40EZ, line 7. (If you have an amount on Section 1,

00

line 4 above, combine that with the amount on line 6 and enter total on Form IT-40EZ, line 7) ____

6

16712111694

1

1 2

2