Form St-28x - Dry Cleaning And Laundry Retailer Exemption Certificate

ADVERTISEMENT

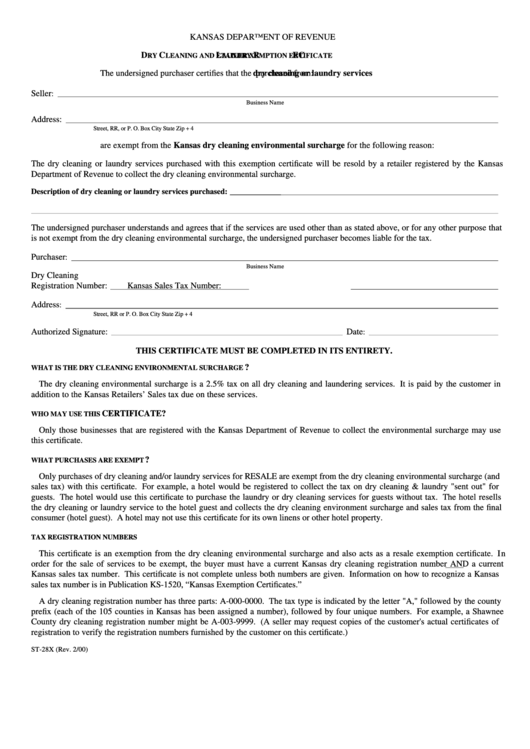

KANSAS DEPARTMENT OF REVENUE

D

C

L

R

E

C

RY

LEANING AND

AUNDRY

ETAILER

XEMPTION

ERTIFICATE

The undersigned purchaser certifies that the

dry cleaning or laundry services

purchased from:

Seller

:

Business Name

Address:

Street, RR, or P. O. Box

City

State

Zip + 4

are exempt from the Kansas dry cleaning environmental surcharge for the following reason:

The dry cleaning or laundry services purchased with this exemption certificate will be resold by a retailer registered by the Kansas

Department of Revenue to collect the dry cleaning environmental surcharge.

Description of dry cleaning or laundry services purchased:

The undersigned purchaser understands and agrees that if the services are used other than as stated above, or for any other purpose that

is not exempt from the dry cleaning environmental surcharge, the undersigned purchaser becomes liable for the tax.

Purchaser

:

Business Name

Dry Cleaning

Registration Number:

Kansas Sales Tax Number:

Address

:

Street, RR or P. O. Box

City

State

Zip + 4

Authorized Signature:

Date

:

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

?

WHAT IS THE DRY CLEANING ENVIRONMENTAL SURCHARGE

The dry cleaning environmental surcharge is a 2.5% tax on all dry cleaning and laundering services. It is paid by the customer in

addition to the Kansas Retailers’ Sales tax due on these services.

CERTIFICATE?

WHO MAY USE THIS

Only those businesses that are registered with the Kansas Department of Revenue to collect the environmental surcharge may use

this certificate.

?

WHAT PURCHASES ARE EXEMPT

Only purchases of dry cleaning and/or laundry services for RESALE are exempt from the dry cleaning environmental surcharge (and

sales tax) with this certificate. For example, a hotel would be registered to collect the tax on dry cleaning & laundry "sent out" for

guests. The hotel would use this certificate to purchase the laundry or dry cleaning services for guests without tax. The hotel resells

the dry cleaning or laundry service to the hotel guest and collects the dry cleaning environment surcharge and sales tax from the final

consumer (hotel guest). A hotel may not use this certificate for its own linens or other hotel property.

TAX REGISTRATION NUMBERS

This certificate is an exemption from the dry cleaning environmental surcharge and also acts as a resale exemption certificate. In

order for the sale of services to be exempt, the buyer must have a current Kansas dry cleaning registration number AND a current

Kansas sales tax number. This certificate is not complete unless both numbers are given. Information on how to recognize a Kansas

sales tax number is in Publication KS-1520, “Kansas Exemption Certificates.”

A dry cleaning registration number has three parts: A-000-0000. The tax type is indicated by the letter "A," followed by the county

prefix (each of the 105 counties in Kansas has been assigned a number), followed by four unique numbers. For example, a Shawnee

County dry cleaning registration number might be A-003-9999. (A seller may request copies of the customer's actual certificates of

registration to verify the registration numbers furnished by the customer on this certificate.)

ST-28X (Rev. 2/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1