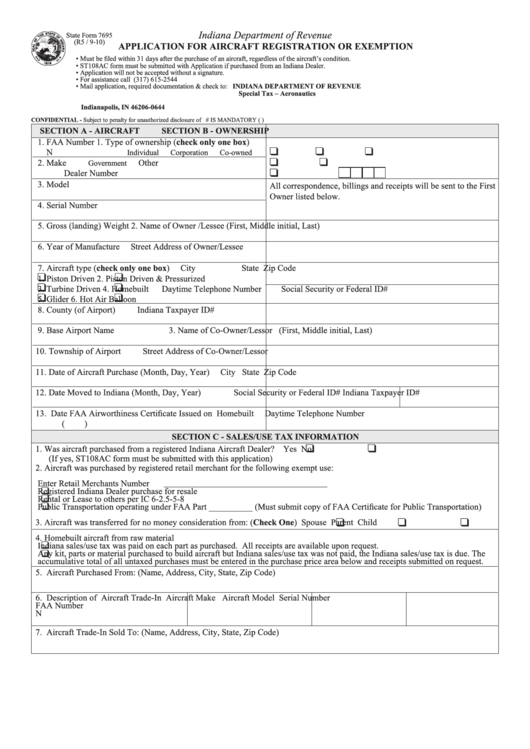

Indiana Department of Revenue

State Form 7695

(R5 / 9-10)

APPLICATION FOR AIRCRAFT REGISTRATION OR EXEMPTION

• Must be filed within 31 days after the purchase of an aircraft, regardless of the aircraft’s condition.

• ST108AC form must be submitted with Application if purchased from an Indiana Dealer.

• Application will not be accepted without a signature.

• For assistance call (317) 615-2544

• Mail application, required documentation & check to: INDIANA DEPARTMENT OF REVENUE

Special Tax – Aeronautics

P.O. Box 644

Indianapolis, IN 46206-0644

CONFIDENTIAL - Subject to penalty for unauthorized disclosure of information.

YOUR SOCIAL SECURITY NUMBER OR FEDERAL ID# IS MANDATORY (I.C. 4-1-8-1)

SECTION A - AIRCRAFT

SECTION B - OWNERSHIP

1. FAA Number

1. Type of ownership (check only one box)

N

Individual

Corporation

Co-owned

2. Make

Other

Government

Dealer Number

3. Model

All correspondence, billings and receipts will be sent to the First

Owner listed below.

4. Serial Number

5. Gross (landing) Weight

2. Name of Owner /Lessee (First, Middle initial, Last)

6. Year of Manufacture

Street Address of Owner/Lessee

7. Aircraft type (check only one box)

City

State

Zip Code

1. Piston Driven

2. Piston Driven & Pressurized

3. Turbine Driven

4. Homebuilt

Daytime Telephone Number

Social Security or Federal ID#

5. Glider

6. Hot Air Balloon

8. County (of Airport)

Indiana Taxpayer ID#

9. Base Airport Name

3. Name of Co-Owner/Lessor (First, Middle initial, Last)

10. Township of Airport

Street Address of Co-Owner/Lessor

11. Date of Aircraft Purchase (Month, Day, Year)

City

State

Zip Code

12. Date Moved to Indiana (Month, Day, Year)

Social Security or Federal ID#

Indiana Taxpayer ID#

13. Date FAA Airworthiness Certificate Issued on Homebuilt

Daytime Telephone Number

(

)

SECTION C - SALES/USE TAX INFORMATION

1. Was aircraft purchased from a registered Indiana Aircraft Dealer?

Yes

No

(If yes, ST108AC form must be submitted with this application)

2. Aircraft was purchased by registered retail merchant for the following exempt use:

Enter Retail Merchants Number

Registered Indiana Dealer purchase for resale

Rental or Lease to others per IC 6-2.5-5-8

Public Transportation operating under FAA Part __________ (Must submit copy of FAA Certificate for Public Transportation)

3. Aircraft was transferred for no money consideration from: (Check One)

Spouse

Parent

Child

4. Homebuilt aircraft from raw material

Indiana sales/use tax was paid on each part as purchased. All receipts are available upon request.

Any kit, parts or material purchased to build aircraft but Indiana sales/use tax was not paid, the Indiana sales/use tax is due. The

accumulative total of all untaxed purchases must be entered in the purchase price area below and receipts submitted on request.

5. Aircraft Purchased From: (Name, Address, City, State, Zip Code)

6. Description of Aircraft Trade-In

Aircraft Make

Aircraft Model

Serial Number

FAA Number

N

7. Aircraft Trade-In Sold To: (Name, Address, City, State, Zip Code)

1

1 2

2 3

3 4

4