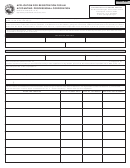

Instructions

SECTION A - AIRCRAFT

1. FAA “N” Number............................................... Assigned to the aircraft by the Federal Aviation Administration (FAA).

2. Make .................................................................. The manufacturer name. (i.e. Cessna, Mooney, Piper)

3. Model ................................................................. The model name or number assigned by manufacturer (i.e. 150, M22, PA28-140).

4. Serial Number .................................................... The serial number assigned to the aircraft (not the engine).

5. Gross (landing) Weight ..................................... The total weight of the aircraft, fuel, passengers, and luggage. Landing weight will

be accepted if less than gross weight but you must submit a copy of your FAA weight

& balance sheet. Empty Weight Is Not Acceptable. Hot Air Balloon should include

basket, envelope, fuel, and passengers. Homebuilt aircraft must submit a copy of FAA

weight & balance sheet.

6. Year of Manufacture ........................................... The year of manufacture of the aircraft reported to the FAA. Homebuilt aircraft use

the year the aircraft was completed.

7. Aircraft Type ...................................................... Check only one box. If the aircraft is a homebuilt and also piston or turbine driven,

check the box for Homebuilt.

8. County (of airport) ............................................. The name of the county where your base airport is located. If you do not store your

hot air balloon or homebuilt at an airport, use the name of the county of your resi-

dence.

9. Base Airport Name ............................................. The official name of the airport where you normally store your aircraft spelled out.

Do not use FAA three letter identifier. If you do not store your hot air balloon or

homebuilt at an airport, indicate “ not applicable” or n/a.

10.Township of Airport .......................................... The taxing district or township where the airport is located. If you do not store

your hot air balloon or homebuilt at an airport, use the township of your residence.

11. Date of Aircraft Purchase ................................. Self explanatory. Homebuilt aircraft use date FAA airworthiness certificate was

issued. A copy of the FAA airworthiness certificate is required.

12. Date moved to Indiana .................................... Non-Resident only - date aircraft moved to Indiana base airport.

13. Date FAA Airworthnesss Certificate was issued... The date the FAA signed your aircraft airworthiness certificate. A copy of your

FAA airworthiness certificate must be submitted with your application

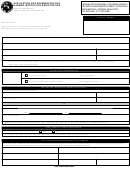

SECTION B - OWNERSHIP

1. Type of Ownership ............................................. Check only one: ownership must match the FAA application you filed.

2. Name and Address of Owner/Lessee,

3. Co-owner/Lessor ................................................ Name and address must match with the name listed on your FAA application.

Attach additional list if necessary. If you are leasing the aircraft and want all billings

mailed to you, list your name first and circle the word “Lessee”. The owner of the

aircraft should be listed in #3 with the word “Lessor” circled.

*Telephone number (during the day) - The area code and number where you can be

reached between 8:00 a.m.and 4:30 p.m. Monday -Friday.

*Social Security Number or Federal ID Number - Individual’s Social Security Num-

ber or the corporation’s Federal Identification is mandatory as per I.C.4-1-8-1. This

information is confidential and will not be released with out a court order.

*Indiana Taxpayer ID Number - The taxpayer’s identification number assigned by

the Indiana Department of Revenue.

SECTION C - SALES AND USE TAX

Sales or use tax is due at the time of registration to the Indiana Department of Revenue each time ownership changes even if you purchased

the aircraft out of state.

1. If your aircraft was purchased from a registered Indiana Aircraft Dealer, you must submit the State form ST-108AC with your

application as proof the sales/use tax was paid to the dealer or a properly completed exemption was filed.

2. You must be registered as a retail merchant with the DOR BEFORE your aircraft was purchased to be exempt from sales/use tax.

Your retail merchants number must be entered, the words “applied for” are not acceptable. You must indicate the exempt use of the

aircraft. If your exempt use is public transportation, you must indicate the FAA Part (135,121) you are operating under and send a

copy of your certificate with your application.

3. If this aircraft was given to you as a result of a divorce, a copy of your divorce decree is required. If the aircraft is transferred

between a parent or child, a sworn affidavit must be completed with the relationship indicated behind each name with $00 as the

selling price.

4. Check the appropriate statement.

5. List the complete name and address of the person from whom the aircraft was purchased.

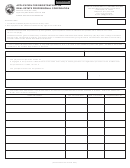

1

1 2

2 3

3 4

4