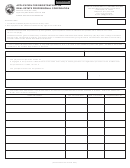

8. Sales and Use Tax Computation: (A detailed bill of sale listing purchase price, invoice, or sworn affidavit signed by seller

must be submitted with this form).

A.

Purchase Price

$

B.

Subtract Trade-in Allowance

-$

C.

Amount Subject to Sales/Use Tax

$

D.

Sales/Use tax due (7% of Line C)

$

(Enter amount on Line 1 of SECTION E)

SECTION D - EXCISE TAX COMPUTATION

TABLE 1 - CLASSES OF AIRCRAFT (Based on Type or Power Sources)

TABLE 2 - TAX RATES (Based on Class, Weight, Age of Air-

craft)

A.

1. Piston-Driven

AIRCRAFT

CLASS A

CLASS B

CLASS C

CLASS D

B.

2. Piston-Driven and Pressurized

AGE

0-4 Years

$ .04/LB

$ .065LB

$ .09/LB $ .0175/LB

C.

3. Turbine-Driven

5-8 Years

.035/LB

.055/LB

.08/LB

.015/LB

D.

4. Homebuilt

5. Glider

6. Hot Air Balloon

9-12 Year

.03/LB

.05/ LB

.07/LB

.0125/LB

TABLE 3 - TAX REDUCTION (Based on month of purchase)

13-16 Years

.025/LB

.025/LB

.025/LB

.01/LB

JAN. FEB. MAR. APR. MAY JUN. JUL. AUG. SEP. OCT. NOV. DEC.

17-25 Years

.02/LB

.02/LB

.02/LB

.0075/LB

N/A N/A N/A

10% 20% 30% 40% 50% 60% 70% 80% 90%

26 & Older

.01/LB

.01/LB

.01/LB

.005/LB

a. Gross landing weight (Section A no. 5)

Tax Rate (Tables 1 and 2)

Gross Tax

X $

=

$

b. Gross Tax

Percent of Tax Reduction (Table 3)

Tax Reduction

$

X

%

= $

1c. FAA number of aircraft sold this year

Excise Tax paid on aircraft sold

1. Tax Credit

N

90% X $

= $

2c.

Number of months remaining in calendar

Percent

Excise tax paid

2. Tax Credit

10% X year AFTER aircraft was sold

=

%

X $

= $

3c. Enter the lowest of 1c and 2c

True Tax Credit

$

d. Compare lines b and 3c. Enter greatest amount

Tax Reduction

or Tax Credit

$

e. Subtract line d from line a. (Enter amount on line 2 Section E)

EXCISE TAX DUE

EXCISE TAX DUE

$

SECTION E - TAX SUMMARY/AMOUNT DUE

TAX YEAR

1. SALES/USE TAX (Enter amount from Section C, line 8D)

$

1a. SALES/USE TAX LATE PENALTY DUE IF PAID AFTER 31 DAY REQUIREMENT

$

1b. SALES/USE TAX INTEREST DUE IF PAID AFTER 31 DAY REQUIREMENT

$

2. EXCISE TAX DUE ON GROSS (LANDING) WEIGHT (Enter amount from Section D, line e) $

3a. LATE PENALTY ON EXCISE TAX (Due if paid after 31 day requirement)

$

3b. LATE INTEREST ON EXCISE TAX (Due if paid after 31 day requirement)

$

4. REGISTRATION FEE/TRANSFER FEE $10.00

$

5. TOTAL AMOUNT DUE (Add line 1 through 4) REMIT AMOUNT PAYABLE TO

INDIANA DEPARTMENT OF REVENUE.

$

SECTION F - CERTIFICATION (APPLICATION WILL NOT BE ACCEPTED WITHOUT SIGNATURE(S))

I/We certify, under the penalties of perjury, that all the information and statements are true and correct to the best of my knowledge.

(Attach signatures if more space is needed.)

Signature of Aircraft Owner/Authorized Person

Date Signed

Signature of Aircraft Co-Owner

Date Signed

Printed Name of Aircraft Owner/Authorized Person Date Signed

Printed Name of Aircraft Co-Owner

Date Signed

1

1 2

2 3

3 4

4