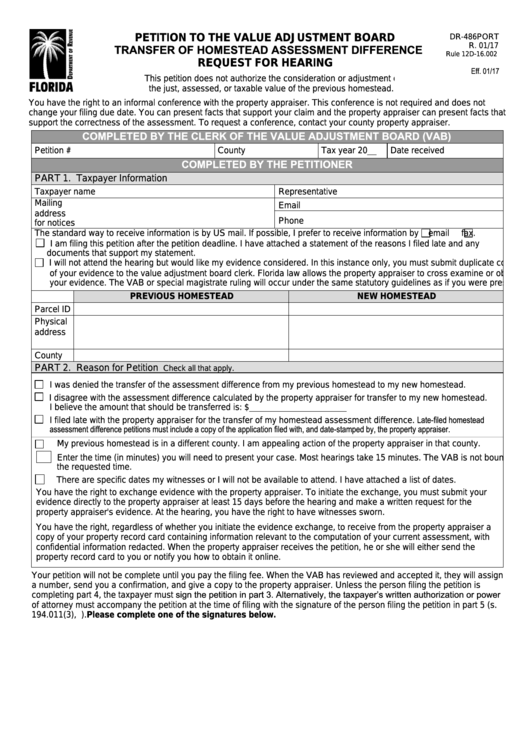

PETITION TO THE VALUE ADJUSTMENT BOARD

DR-486PORT

R. 01/17

TRANSFER OF HOMESTEAD ASSESSMENT DIFFERENCE

Rule 12D-16.002

F.A.C.

REQUEST FOR HEARING

Eff. 01/17

This petition does not authorize the consideration or adjustment of

the just, assessed, or taxable value of the previous homestead.

You have the right to an informal conference with the property appraiser. This conference is not required and does not

change your filing due date. You can present facts that support your claim and the property appraiser can present facts that

support the correctness of the assessment. To request a conference, contact your county property appraiser.

COMPLETED BY THE CLERK OF THE VALUE ADJUSTMENT BOARD (VAB)

Petition #

County

Tax year 20

Date received

COMPLETED BY THE PETITIONER

PART 1. Taxpayer Information

Taxpayer name

Representative

Mailing

Email

address

Phone

for notices

The standard way to receive information is by US mail. If possible, I prefer to receive information by

email

fax.

I am filing this petition after the petition deadline. I have attached a statement of the reasons I filed late and any

documents that support my statement.

I will not attend the hearing but would like my evidence considered. In this instance only, you must submit duplicate copies

of your evidence to the value adjustment board clerk. Florida law allows the property appraiser to cross examine or object to

your evidence. The VAB or special magistrate ruling will occur under the same statutory guidelines as if you were present.

PREVIOUS HOMESTEAD

NEW HOMESTEAD

Parcel ID

Physical

address

County

PART 2. Reason for Petition

Check all that apply.

I was denied the transfer of the assessment difference from my previous homestead to my new homestead.

I disagree with the assessment difference calculated by the property appraiser for transfer to my new homestead.

I believe the amount that should be transferred is: $

I filed late with the property appraiser for the transfer of my homestead assessment difference. Late-filed homestead

assessment difference petitions must include a copy of the application filed with, and date-stamped by, the property appraiser.

My previous homestead is in a different county. I am appealing action of the property appraiser in that county.

Enter the time (in minutes) you will need to present your case. Most hearings take 15 minutes. The VAB is not bound by

the requested time.

There are specific dates my witnesses or I will not be available to attend. I have attached a list of dates.

You have the right to exchange evidence with the property appraiser. To initiate the exchange, you must submit your

evidence directly to the property appraiser at least 15 days before the hearing and make a written request for the

property appraiser's evidence. At the hearing, you have the right to have witnesses sworn.

You have the right, regardless of whether you initiate the evidence exchange, to receive from the property appraiser a

copy of your property record card containing information relevant to the computation of your current assessment, with

confidential information redacted. When the property appraiser receives the petition, he or she will either send the

property record card to you or notify you how to obtain it online.

Your petition will not be complete until you pay the filing fee. When the VAB has reviewed and accepted it, they will assign

a number, send you a confirmation, and give a copy to the property appraiser. Unless the person filing the petition is

completing part 4, the taxpayer must sign the petition in part 3. Alternatively, the taxpayer’s written authorization or power

of attorney must accompany the petition at the time of filing with the signature of the person filing the petition in part 5 (s.

194.011(3), F.S.). Please complete one of the signatures below.

1

1 2

2