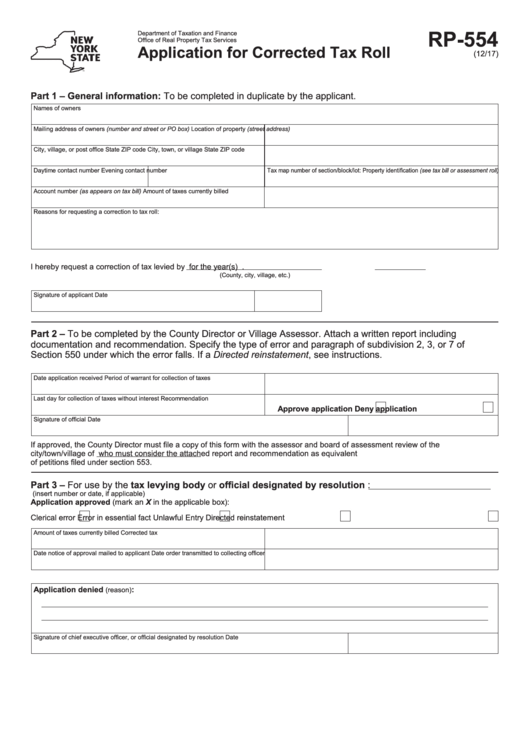

RP-554

Department of Taxation and Finance

Office of Real Property Tax Services

Application for Corrected Tax Roll

(12/17)

Part 1 – General information: To be completed in duplicate by the applicant.

Names of owners

Mailing address of owners (number and street or PO box)

Location of property (street address)

City, village, or post office

State

ZIP code

City, town, or village

State

ZIP code

Daytime contact number

Evening contact number

Tax map number of section/block/lot: Property identification (see tax bill or assessment roll)

Account number (as appears on tax bill)

Amount of taxes currently billed

Reasons for requesting a correction to tax roll:

I hereby request a correction of tax levied by

for the year(s)

.

(County, city, village, etc.)

Signature of applicant

Date

Part 2 – To be completed by the County Director or Village Assessor. Attach a written report including

documentation and recommendation. Specify the type of error and paragraph of subdivision 2, 3, or 7 of

Section 550 under which the error falls. If a Directed reinstatement, see instructions.

Date application received

Period of warrant for collection of taxes

Last day for collection of taxes without interest

Recommendation

Approve application

Deny application

Signature of official

Date

If approved, the County Director must file a copy of this form with the assessor and board of assessment review of the

city/town/village of

who must consider the attached report and recommendation as equivalent

of petitions filed under section 553.

Part 3 – For use by the tax levying body or official designated by resolution

:

(insert number or date, if applicable)

Application approved (mark an X in the applicable box):

Clerical error

Error in essential fact

Unlawful Entry

Directed reinstatement

Amount of taxes currently billed

Corrected tax

Date notice of approval mailed to applicant

Date order transmitted to collecting officer

Application denied

:

(reason)

Signature of chief executive officer, or official designated by resolution

Date

1

1 2

2