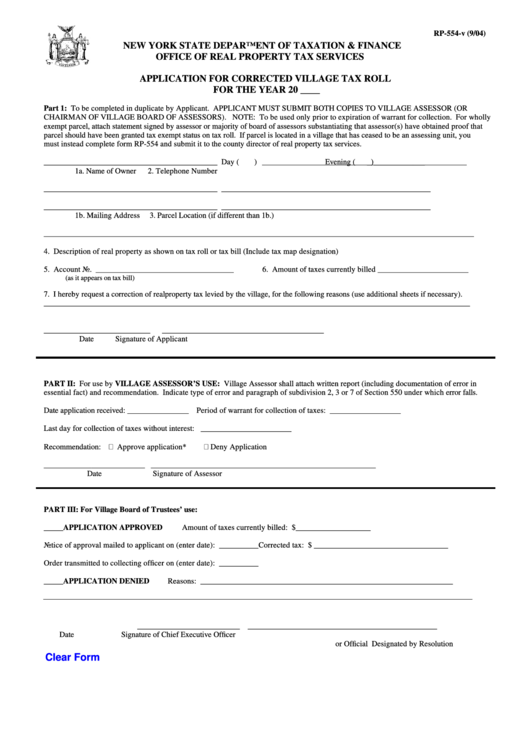

RP-554-v (9/04)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR CORRECTED VILLAGE TAX ROLL

FOR THE YEAR 20 ____

Part 1: To be completed in duplicate by Applicant. APPLICANT MUST SUBMIT BOTH COPIES TO VILLAGE ASSESSOR (OR

CHAIRMAN OF VILLAGE BOARD OF ASSESSORS). NOTE: To be used only prior to expiration of warrant for collection. For wholly

exempt parcel, attach statement signed by assessor or majority of board of assessors substantiating that assessor(s) have obtained proof that

parcel should have been granted tax exempt status on tax roll. If parcel is located in a village that has ceased to be an assessing unit, you

must instead complete form RP-554 and submit it to the county director of real property tax services.

____________________________________________

Day (

)

Evening (

_)_____________

1a. Name of Owner

2. Telephone Number

____________________________________________

_____________________________________________________

____________________________________________

_____________________________________________________

1b. Mailing Address

3. Parcel Location (if different than 1b.)

_____________________________________________________________________________________________________________

4. Description of real property as shown on tax roll or tax bill (Include tax map designation)

5. Account No. ___________________________________

6. Amount of taxes currently billed _______________________

(as it appears on tax bill)

7. I hereby request a correction of real property tax levied by the village, for the following reasons (use additional sheets if necessary).

____________________________________________________________________________________________________________

___________________________

_________________________________________

Date

Signature of Applicant

PART II: For use by VILLAGE ASSESSOR’S USE: Village Assessor shall attach written report (including documentation of error in

essential fact) and recommendation. Indicate type of error and paragraph of subdivision 2, 3 or 7 of Section 550 under which error falls.

Date application received: ________________

Period of warrant for collection of taxes: __________________

Last day for collection of taxes without interest: _______________________

Recommendation:

Approve application*

Deny Application

__________________________

_________________________________________________________

Date

Signature of Assessor

PART III: For Village Board of Trustees’ use:

_____APPLICATION APPROVED

Amount of taxes currently billed: $___________________

Notice of approval mailed to applicant on (enter date): __________

Corrected tax: $ __________________________________

Order transmitted to collecting officer on (enter date): __________

_____APPLICATION DENIED

Reasons: ________________________________________________________________

__________________________

________________________________________________

Date

Signature of Chief Executive Officer

or Official Designated by Resolution

Clear Form

1

1 2

2