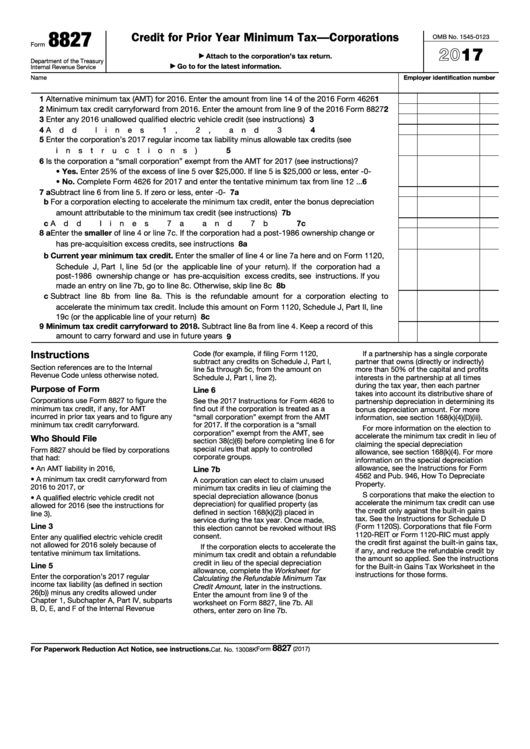

8827

Credit for Prior Year Minimum Tax—Corporations

OMB No. 1545-0123

Form

2017

Attach to the corporation’s tax return.

▶

Department of the Treasury

Go to for the latest information.

Internal Revenue Service

▶

Employer identification number

Name

1

Alternative minimum tax (AMT) for 2016. Enter the amount from line 14 of the 2016 Form 4626

1

2

Minimum tax credit carryforward from 2016. Enter the amount from line 9 of the 2016 Form 8827

2

3

3

Enter any 2016 unallowed qualified electric vehicle credit (see instructions) .

.

.

.

.

.

.

4

Add lines 1, 2, and 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Enter the corporation’s 2017 regular income tax liability minus allowable tax credits (see

5

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Is the corporation a “small corporation” exempt from the AMT for 2017 (see instructions)?

• Yes. Enter 25% of the excess of line 5 over $25,000. If line 5 is $25,000 or less, enter -0-

• No. Complete Form 4626 for 2017 and enter the tentative minimum tax from line 12

6

.

.

.

7 a Subtract line 6 from line 5. If zero or less, enter -0- .

7a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b For a corporation electing to accelerate the minimum tax credit, enter the bonus depreciation

amount attributable to the minimum tax credit (see instructions) .

.

.

.

.

.

.

.

.

.

.

7b

c Add lines 7a and 7b

7c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8 a Enter the smaller of line 4 or line 7c. If the corporation had a post-1986 ownership change or

has pre-acquisition excess credits, see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8a

b Current year minimum tax credit. Enter the smaller of line 4 or line 7a here and on Form 1120,

Schedule J, Part I, line 5d (or the applicable line of your return). If the corporation had a

post-1986 ownership change or has pre-acquisition excess credits, see instructions. If you

8b

made an entry on line 7b, go to line 8c. Otherwise, skip line 8c .

.

.

.

.

.

.

.

.

.

.

c Subtract line 8b from line 8a. This is the refundable amount for a corporation electing to

accelerate the minimum tax credit. Include this amount on Form 1120, Schedule J, Part II, line

19c (or the applicable line of your return)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8c

9

Minimum tax credit carryforward to 2018. Subtract line 8a from line 4. Keep a record of this

amount to carry forward and use in future years .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Instructions

Code (for example, if filing Form 1120,

If a partnership has a single corporate

subtract any credits on Schedule J, Part I,

partner that owns (directly or indirectly)

Section references are to the Internal

line 5a through 5c, from the amount on

more than 50% of the capital and profits

Revenue Code unless otherwise noted.

Schedule J, Part I, line 2).

interests in the partnership at all times

during the tax year, then each partner

Purpose of Form

Line 6

takes into account its distributive share of

Corporations use Form 8827 to figure the

See the 2017 Instructions for Form 4626 to

partnership depreciation in determining its

minimum tax credit, if any, for AMT

find out if the corporation is treated as a

bonus depreciation amount. For more

incurred in prior tax years and to figure any

“small corporation” exempt from the AMT

information, see section 168(k)(4)(D)(iii).

minimum tax credit carryforward.

for 2017. If the corporation is a “small

For more information on the election to

corporation” exempt from the AMT, see

accelerate the minimum tax credit in lieu of

Who Should File

section 38(c)(6) before completing line 6 for

claiming the special depreciation

special rules that apply to controlled

Form 8827 should be filed by corporations

allowance, see section 168(k)(4). For more

corporate groups.

that had:

information on the special depreciation

allowance, see the Instructions for Form

• An AMT liability in 2016,

Line 7b

4562 and Pub. 946, How To Depreciate

• A minimum tax credit carryforward from

A corporation can elect to claim unused

Property.

2016 to 2017, or

minimum tax credits in lieu of claiming the

S corporations that make the election to

special depreciation allowance (bonus

• A qualified electric vehicle credit not

accelerate the minimum tax credit can use

depreciation) for qualified property (as

allowed for 2016 (see the instructions for

the credit only against the built-in gains

defined in section 168(k)(2)) placed in

line 3).

tax. See the Instructions for Schedule D

service during the tax year. Once made,

Line 3

(Form 1120S). Corporations that file Form

this election cannot be revoked without IRS

1120-REIT or Form 1120-RIC must apply

consent.

Enter any qualified electric vehicle credit

the credit first against the built-in gains tax,

not allowed for 2016 solely because of

If the corporation elects to accelerate the

if any, and reduce the refundable credit by

tentative minimum tax limitations.

minimum tax credit and obtain a refundable

the amount so applied. See the instructions

credit in lieu of the special depreciation

Line 5

for the Built-in Gains Tax Worksheet in the

allowance, complete the Worksheet for

instructions for those forms.

Enter the corporation’s 2017 regular

Calculating the Refundable Minimum Tax

income tax liability (as defined in section

Credit Amount, later in the instructions.

26(b)) minus any credits allowed under

Enter the amount from line 9 of the

Chapter 1, Subchapter A, Part IV, subparts

worksheet on Form 8827, line 7b. All

B, D, E, and F of the Internal Revenue

others, enter zero on line 7b.

8827

For Paperwork Reduction Act Notice, see instructions.

Form

(2017)

Cat. No. 13008K

1

1 2

2