Page 2

INSTRUCTIONS FOR FORM 656−L, OFFER IN COMPROMISE (DOUBT AS TO LIABILITY)

What you need to know

Your Rights as a Taxpayer

Each and every taxpayer has a set of fundamental rights they should be aware of

when dealing with the IRS. Explore your rights and our obligations to protect them.

For more information on your rights as a taxpayer,

Bill-of-Rights.

What is a Doubt as to

Doubt as to liability exists where there is a genuine dispute as to the existence or

Liability offer?

amount of the correct tax debt under the law. If you have a legitimate doubt that

you owe part or all of the tax debt, you will need to complete a Form 656-L, Offer in

Compromise (Doubt as to Liability).

Doubt as to liability cannot be disputed or considered if the tax debt has been

established by a final court decision or judgment concerning the existence or

amount of the assessed tax debt or if the assessed tax debt is based on current

law.

Submitting an offer application does not guarantee that the IRS will accept your

offer. It begins a process of evaluation and verification by the IRS.

If you have supplied information to the Internal Revenue Service or are responding

to a notice you received relating to the same matter for which you are submitting

your offer, you should resolve the outstanding issues prior to filing the offer. If your

issue is being worked by another area, for example you have requested audit

reconsideration to resolve whether you are liable for the tax, then an offer should

not be filed until the issue is resolved. Failure to follow-up and resolve an issue

may lead to the IRS returning the offer without further consideration.

A doubt as to liability offer will only be considered for the tax period(s) in question.

Note: If you agree that you owe the tax but cannot afford to pay, DO NOT

FILE a Form 656-L. See below "What if I agree with the tax debt but cannot

afford to pay in full?", for additional information.

If you file the wrong type of offer, your offer will be returned without further

consideration.

What documentation or

You must provide a written statement explaining why the tax debt or portion of the

support is needed?

tax debt is incorrect. In addition, you should provide supporting documentation or

evidence that will help the IRS identify the reason(s) you doubt the accuracy of the

tax debt. If you are unable to reconstruct your books and records, you can provide

an explanation that supports reasonable doubt justifying a reduction to a portion or

all of your tax debt.

Note: Failing to provide a written statement explaining why the tax debt or a

portion of the debt is incorrect will cause your offer to be returned without

further consideration.

How much should I offer?

In order to qualify, you must make an offer that is $1 or more and should be based

on what you believe the correct amount of tax should be. If you believe you do not

owe any tax, you should pursue alternative solutions listed below. See “What

alternatives do I have to sending in an Offer in Compromise (Doubt as to

Liability)?", for additional information.

Note: Do not include any payment(s) with the Form 656-L. No deposit or

application fee is required for a doubt as to liability offer.

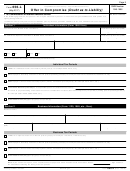

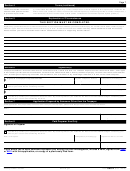

656-L

Catalog Number 47516R

Form

(Rev. 1-2018)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8