Instructions For Form 8959 - Additional Medicare Tax - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 8959

Additional Medicare Tax

Section references are to the Internal Revenue Code

considered for purposes of this tax. Railroad

threshold amount for your filing status in the

unless otherwise noted.

retirement (RRTA) compensation should be

chart on this page.

separately compared to the threshold.

Your Medicare wages include your wages

Future Developments

Your employer is responsible for

and tips from Form W-2, box 5; your tips

withholding the 0.9% Additional Medicare

from Form 4137, line 6; and your wages from

For the latest information about

Tax on your Medicare wages or railroad

Form 8919, line 6.

developments related to Form 8959 and its

retirement (RRTA) compensation paid in

Your self-employment income includes

instructions, such as legislation enacted after

excess of $200,000 in a calendar year. Your

amounts from Schedule SE – Section A,

they were published, go to

IRS.gov/

employer is required to begin withholding

line 4, or Section B, line 6. But negative

Form8959.

Additional Medicare Tax in the pay period in

amounts shouldn't be considered for

which your wages or compensation for the

purposes of Form 8959.

Reminders

year exceed $200,000 and continue to

If your Medicare wages, railroad

withhold it in each pay period for the

retirement (RRTA) compensation, or

Missing or incorrect Form W-2. Your

remainder of the calendar year.

self-employment income is adjusted, you

employer is required to furnish Form W-2 to

More information. The IRS and the

may need to correct your liability, if any, for

you no later than January 31, 2018. If you

Treasury Department have issued final

Additional Medicare Tax. When correcting

don't receive your Form W-2 by early

regulations (T.D. 9645) on the Additional

Additional Medicare Tax liability, attach a

February, see Tax Topic 154 to find out what

Medicare Tax. The final regulations are

corrected Form 8959, to your original return

to do. Tax topics are available at

IRS.gov/

available at

IRS.gov/irb/2013-51_IRB/

or amended return, as applicable. If you are

TaxTopics. Even if you don't get a Form W-2,

ar10.html. For more information on

correcting Medicare wages or railroad

you must still figure your Additional Medicare

Additional Medicare Tax, go to

IRS.gov/

retirement (RRTA) compensation, also

Tax. If you lose your Form W-2 or it is

ADMT.

attach Form W-2, Wage and Tax Statement,

incorrect, ask your employer for a new one.

or Form W-2c, Corrected Wage and Tax

Who Must File

Forms W-2 of U.S. Possessions.

Statement.

References to Form W-2 on Form 8959 and

You must file Form 8959 if one or more of the

Amounts Subject to

in these instructions also apply to Forms

following applies to you.

W-2AS, W-2CM, W-2GU, W-2VI, and

Additional Medicare Tax

Your Medicare wages and tips on any

499R-2/W-2PR. However, for Form 499R-2/

single Form W-2 (box 5) are greater than

W-2PR, Medicare wages and tips are

All wages that are subject to Medicare tax

$200,000.

reported in Box 19 and Medicare tax

are subject to Additional Medicare Tax to the

Your railroad retirement (RRTA)

withheld is reported in Box 20.

extent they exceed the threshold amount for

compensation on any single Form W-2

your filing status. For more information on

(box 14) is greater than $200,000.

General Instructions

what wages are subject to Medicare tax, see

Your total Medicare wages and tips plus

the chart, Special Rules for Various Types of

your self-employment income (including the

Services and Payments, in section 15 of

Medicare wages and tips and

Purpose of Form

Pub. 15, Employer’s Tax Guide.

self-employment income of your spouse, if

Use Form 8959 to figure the amount of

married filing jointly) are greater than the

Your employer must withhold Additional

Additional Medicare Tax you owe and the

threshold amount for your filing status in the

Medicare Tax on wages it pays to you in

amount of Additional Medicare Tax withheld

chart on this page.

excess of $200,000 for the calendar year,

by your employer, if any. You will carry the

Your total railroad retirement (RRTA)

regardless of your filing status and

amounts to one of the following returns.

compensation and tips (Form W-2, box 14)

regardless of wages or compensation paid

Form 1040.

(including the railroad retirement (RRTA)

by another employer.

Form 1040NR.

compensation and tips of your spouse, if

Form 1040-SS.

married filing jointly) is greater than the

All railroad retirement (RRTA)

Form 1040-PR.

compensation that is currently subject to

Attach Form 8959 to your return.

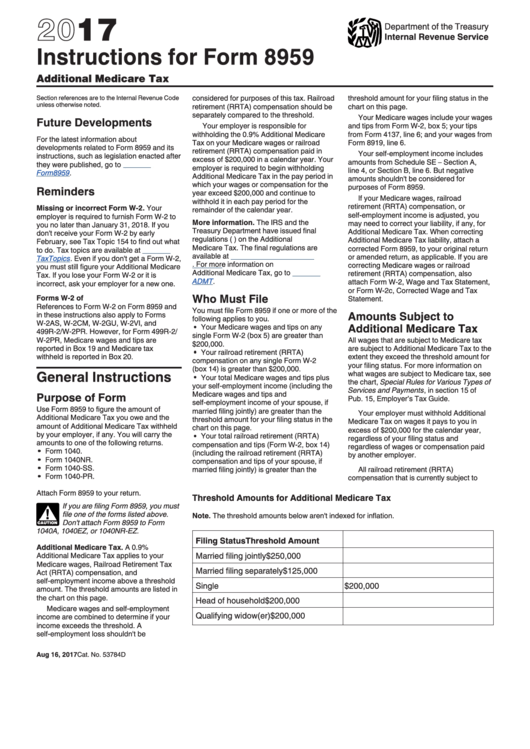

Threshold Amounts for Additional Medicare Tax

If you are filing Form 8959, you must

file one of the forms listed above.

!

Note. The threshold amounts below aren't indexed for inflation.

Don't attach Form 8959 to Form

CAUTION

1040A, 1040EZ, or 1040NR-EZ.

Filing Status

Threshold Amount

Additional Medicare Tax. A 0.9%

Married filing jointly

$250,000

Additional Medicare Tax applies to your

Medicare wages, Railroad Retirement Tax

Married filing separately

$125,000

Act (RRTA) compensation, and

self-employment income above a threshold

Single

$200,000

amount. The threshold amounts are listed in

the chart on this page.

Head of household

$200,000

Medicare wages and self-employment

Qualifying widow(er)

$200,000

income are combined to determine if your

income exceeds the threshold. A

self-employment loss shouldn't be

Aug 16, 2017

Cat. No. 53784D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4